US still plundering global wealth

Senate bill on currency exchange rates is another attempt to shift the cost of its crisis to others

The passage by the US Senate of a bill aimed at pressuring China into appreciating the value of its currency, at a time when the world's largest economy still faces a very gloomy prospect of recovery, highlights the efforts of the United States to use the issue of the yuan's exchange rate to shift outward the US' domestic crises and problems.

The US has become accustomed to boosting its national wealth and reducing its economic risks by using money from other countries.

The US dollar's status as a global reserve currency makes it convenient for Washington to buy foreign products and services by increasing the issuance of the dollar and to use dollar reserves held by other countries at a low interest rate.

The dollar's status as the leading global reserve currency also makes it convenient for the US to finance its national debt in overseas markets, a move that has facilitated an international circulation of the debt-dependent US economy.

Since 2000, the volume of US debt has increased year-on-year and is now 32 percent of the world's total foreign debt. In 2009, the US foreign debt ratio increased to 95.9 percent from 62.3 percent in 2003, an increase of 33.6 percentage points within seven years. Currently, the total volume of US foreign debt has rocketed to $14.5 trillion (10.5 trillion euros).

The US has also got used to increasing national wealth through dollar depreciation or monetization of its national debt. As the dollar is the world's leading currency, increased dollar issuance can help the US fulfill its obligations to pay off foreign debt or dilute its debt burden. As the result of dollar depreciation, the US evaporated $3.58 trillion in foreign debt from 2002 to 2006.

The two rounds of quantitative easing monetary policy adopted by the US Federal Reserve are essentially monetization of US debt. Through nationalization of private debt first and then internationalization of its national debt, the US has skillfully shifted the cost of its crisis to other countries.

The Federal Reserve's often-employed strategy to buy a large volume of US debt to bolster global liquidity highlights Washington's intention of accelerating this process. In 2009, the world's foreign reserves accounted for 13 percent of its gross domestic product, of which 60 percent belonged to dollar-denominated assets, or more than $5 trillion, while the dollar-priced assets held by foreign countries, excluding their financial derivatives, grew to 1.25 times of the nominal GDP of the US. Dollar devaluation, however, has resulted in the drastic dwindling of such a large bulk of global reserve wealth and purchasing capacity, a plundering by the US of global wealth.

The quantitative easing policy adopted by the US-led developed countries has to a large extent contributed to imbalances in global monetary policy, which has in return further aggravated global trade imbalances. The ever-growing imported inflationary pressures in emerging markets as a result of this quantitative easing monetary policy has had a negative impact on emerging countries' manufacturing-led economies.

Global manufacturing has shifted from developed countries to emerging markets while the global monetary and financial center remains in developed countries.

With the deepening of de-industrialization in the US and the expansion of its current account deficit, the financial sector has increasingly replaced traditional manufacturing and trade to become the driving force of US economic growth. In this process, the US has harvested huge economic profits through long-term, large-volume outward investment.

In view of their less-developed financial markets and financial systems, exchange rate and assets risks on emerging markets caused by their dependence on the world's reserve currencies for pricing, settlement, borrowing and lending and investment still remain unavoidable.

By taking advantage of the dollar's status as the leading international currency and its dominance in global finance, the US has gained the lion's shares of the global wealth distribution and capital returns have become the main channel for Washington to acquire global surplus value.

As the world's leading settlement currency, the dollar-led international monetary system has always been developed to the advantage of the US. At a time when the global economy is still off track, the US is using the pretext of promoting "global economic rebalancing" to force the yuan to rise in value and continuously escalating its disputes with China on exchange rate issues.

At the G20 summit in Seoul last year, the US submitted a so-called program to measure global economic balancing, in an attempt to set limitations on China, Germany and other countries that enjoy a favorable trade status and levy trade tax on other economies through pushing for the appreciation of their currencies.

So in fact it is the US that has gained the largest benefits from global economic imbalances through its firmly controlled dollar hegemony.

The author is an economics researcher with the State Information Center. The views expressed do not necessarily reflect those of China Daily.

Today's Top News

- China Daily launches 'China Bound' — an English-language smart-tourism service platform for international travelers

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan

- Ties with Russia expected to bear fruits

- Confidence, resolve mark China's New Year outlook

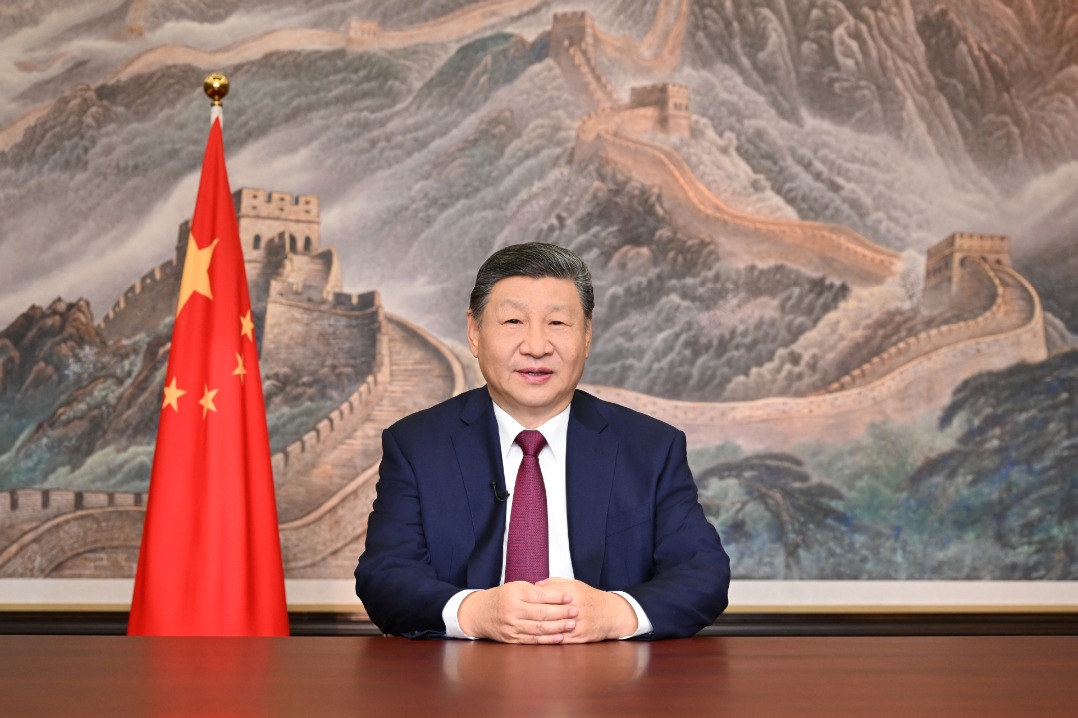

- Xi urges solid work for more progress