Manufacturing goes up value chain

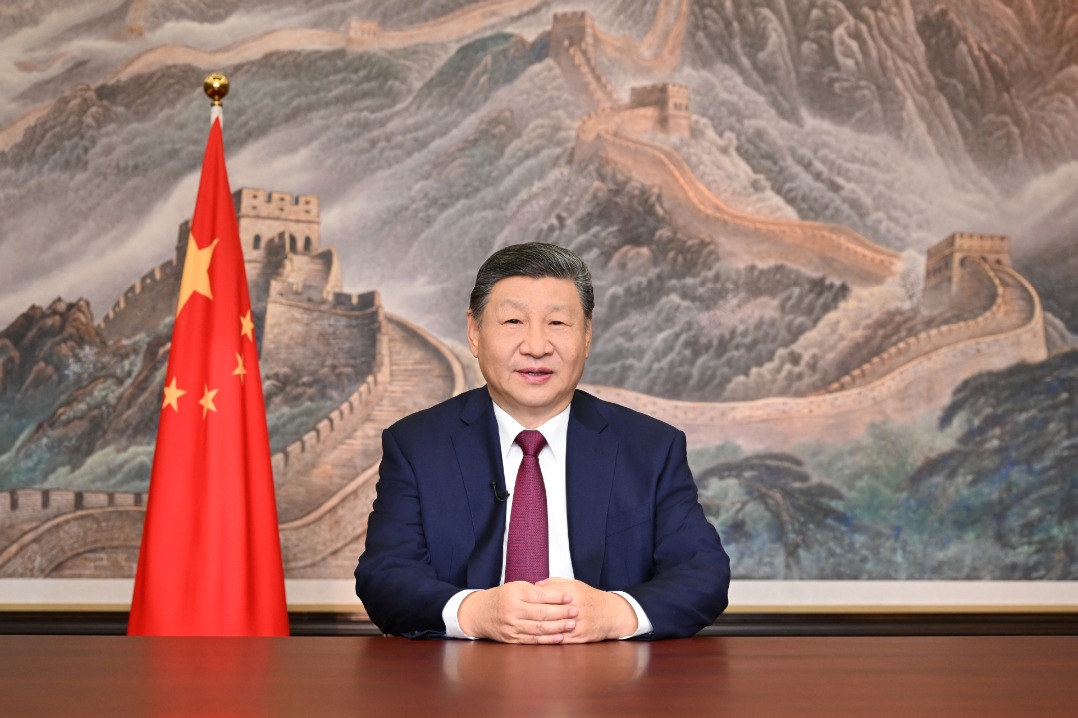

| Stephen Joske, director of Access China at the Economist Intelligence Unit, says China's manufacturing industry will undergo another evolution. Zhang Tao / China Daily |

Major destination of exports will be developing markets

The emergence of the Chinese consumer will provide the necessary lifeline for the country's manufacturing industry, according to a leading economic expert.

Stephen Joske, director of Access China at the Economist Intelligence Unit (EIU) in Beijing and who has produced a number of studies on the competitiveness of China's manufacturing industry, says the sector should not be written off despite competition from lower labor cost countries in Southeast Asia.

"The growth of the Chinese market over the next 20 years means the country will require a lot of manufacturing.

"To say that China has only five, 10 or 15 years left as a manufacturing nation is a bit simplistic since because China is so big it will always have its own internal demand for manufactured goods."

According to Joske, China's manufacturing industry will undergo another evolution over the next 12 months.

For the last 15 years, China has been the major supplier of inexpensive manufactured goods to Western markets, helping keep inflation in these countries low; but from 2012, the major destination of Chinese exports will be the developing markets of Latin America, Africa and the Middle East.

Joske argues in a recent report - Heavy Duty: China's Next Wave of Exports, published by the EIU - that these markets will, with increasing domestic demand, bolster Chinese manufacturing in the future.

"China's manufacturing is moving up the value chain and they are now better able to produce goods that are attractive to these developing markets rather than the old export model of producing cheaper goods for the developed markets," he says.

He insists China's manufacturing competitive advantage is now in such areas as construction equipment making cranes and heavy machinery instead of textiles, where its advantage has been eroded by increases in labor costs.

China's global export market share in construction equipment has risen from just 2.3 percent in 2001 to a significant 10.2 percent in 2010 and is well set to overtake Japan which had a 10.8 percent share last year. It is no longer far behind Germany with an 11.5 percent share or even the United States' 15.7 percent.

"Gone are the days when the West had the luxury of worrying about low-end textiles and shoe exports from China," says Joske.

"The future of exports from China will be led by equipment manufacturers, and although these may not yet be penetrating Western markets, competition in third markets (in the developing world) is intensifying."

The success in construction equipment has been a boon to inland areas such as Hunan province. Three of China's major construction equipment manufacturers, Sany, Zoomlion and Sunward are based in Changsha, the provincial capital. China's earlier manufacturing success boosted the coastal regions of Guangdong, where the first special economic zones (SEZs) were set up in the 1980s.

"The rise of Chinese equipment manufacturers and their establishment of closer commercial ties with other emerging markets has been a key driver for recent boom conditions in China's inland provinces," he says.

Joske, who is also a board member of Austcham, the Australian Chamber of Commerce in Beijing, has been at the Economist Intelligence Unit since 2008.

He was previously senior Australian Treasury representative at the Australian embassy in the Chinese capital.

Before coming to China, the graduate in economics and Asian studies from the Australian National University in Canberra worked as a senior adviser at the Australian Treasury.

He says some manufacturing exports to Australia are symptomatic of what is happening in other parts of the world.

"Australia is not a developing country but China has started exporting motor vehicles there.

"They are clearly lower quality but the prices are excellent and they sell well. That pattern is being repeated around the world."

He says China has no option but to move up the value chain because of the rise in wages.

Wages in Guangdong, China's manufacturing heartland, have increased by 158 percent in the 10 years to 2010 to an average of 40,432 yuan a year ($6,340, 4,600 euros), according to EIU figures. They jumped no less than 11 percent in 2010 alone.

Labor rates in another coastal manufacturing heartland, Zhejiang province, just south of Shanghai, have also increased similarly over the last decade to 40,640 yuan.

Wages in these areas are no longer that far behind those in Beijing (65,158 yuan) or Shanghai (66,115 yuan).

Many manufacturers have therefore opted to western parts of China such as Chongqing, where average wages are 34,727 yuan. Perhaps worryingly for them, wage rates in this Western city have shown a 265 percent rise over the last 10 years, one of the steepest in the country.

"There is still a very big absolute gap between wage rates in the cheaper inland areas and the east coast cities, even though wage rates have been growing at a similar rate," adds Joske.

"That is why manufacturers are moving factories to the west of China. Chongqing is particularly attractive because it is on the Yangtze River and water transport is always the cheapest form of transportation."

Joske says many of China's manufacturers of cheaper goods have tended not to make the journey inland but move to cheaper areas nearby.

"What we are seeing in places like Guangdong is migration within the province. It has certainly been explicit government policy to encourage development within areas of the region and move companies out of the main cities of Shenzhen and Guangzhou," he says.

Joske believes there isn't the scope for much of Chinese manufacturing or for foreign manufacturing currently in China to move to parts of Southeast Asia in search of lower wage rates as many people think.

"I think companies doing this are really on the margins. If everyone moved to Vietnam, Vietnamese wage rates would be so high it would not be worth the trouble because there is a natural limit," he says. "Vietnam might have a big population but it is significantly smaller than that of China."

Joske adds that China's manufacturing has recovered well from the sharp downturn in world trade following the collapse of Lehman Brothers when the demand for its manufacturing exports slumped by 30 percent in a matter of months.

"China has recovered very quickly by redirecting its exports to developing markets such as Latin America, Africa and the Middle East and it has been a very quick and efficient process," he says.

He says the country has managed to remain a major global manufacturing center by finding a new niche for itself.

"As well as areas like construction equipment, it has also started producing low-end electronics and electrical white goods. These are not particularly complex pieces of machinery and it has always been involved in the assembly side of these but it is now doing some of the more complex parts of the work itself," he says.

"While Western companies produce top quality premium products, the Chinese niche now is to make the same type of product but at better prices that represent better value for customers in developing countries that have tighter budgets."

Today's Top News

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan