More pros, less cons

With some steps, Chinese investment in Africa will become increasingly beneficial

In 2005, private Chinese businesses began making inroads into the African market. This new trend in China's foreign direct investment is increasingly replacing state-owned enterprises as the engine of Sino-African economic ties. As of April 2012, China's direct investment in Africa had reached $15.3 billion, while 10 years ago this figure was less than $500 million. More than 2,000 Chinese enterprises have invested in Africa, more than half of which are private enterprises.

In Africa, China's private capital was previously limited to industries such as catering and retailing. But in recent years, with their strength and influence now tapping into a more globalized arena, Chinese private businesses have expanded into the likes of the project-contracting, pharmaceutical, textile, machinery and telecommunication fields.

Chinese companies have also started to venture into fields such as agriculture, mining and energy. Although they may not be able to bring lucrative profits in the short term, they are of great economic importance to the development of Africa.

Except for a few big companies such as Huawei and ZTE, most Chinese private enterprises in Africa are basically small and medium-sized and have a lot in common.

First, they have gradually become more rational in management. According to the China-Africa Business Council, private businesses in the past were often not well organized, while the past two years have witnessed a trend toward rationalization. More consulting, investigation and other preparatory work are carried out before formal investment.

Second, unlike state-owned enterprises, private enterprises rely more on local labor. Local labor even accounts for more than 90 percent of some companies' workforces.

Third, private enterprises often face more challenges compared with state-owned enterprises. They are not that familiar with the local language, culture and market information, which makes it difficult for them to capture market opportunities. They also lack sufficient funds to expand their business in general.

Compared with government-investment projects, the financing difficulties of private enterprises have always shackled their investment in Africa. African banks won't open their doors, and Chinese banks pave no easy road for them either.

There are three traditional financing options for qualifying Chinese companies to obtain low-interest policy loans: traditional government-to-government transactions and trade financing supported by the Export-Import Bank of China; resources-project financing provided by China Development Bank; and government project funding provided by the China-Africa Development Fund. This shows that the majority of these policy-financing channels are meant for government-investment projects, and there is limited room for private enterprise.

Chinese commercial banks are very cautious when it comes to overseas investment loans. Not only is it difficult to evaluate the objectives of African investment, but foreign-exchange and other risks also make it difficult for small and medium-sized private enterprises to obtain substantial financial support from commercial banks.

Similarly, these enterprises lack borrowing experience in Africa. African banks likewise have little experience in loans to Chinese enterprises, not to mention Chinese SMEs.

Therefore, the financing predicament in both directions has prevented many who also want to join the "gold rush". It is up to the government to solve this dilemma. If the government better coordinates domestic lenders, and holds a controlling stake in African financial institutions, there will be more financing channels for SMEs.

The more intuitive approach is to encourage more domestic banks to acquire stakes in large African banks, which can indirectly facilitate loans for Chinese private enterprises in Africa. A one-time investment can save the trouble of the approval process and cost of opening outlets in Africa.

In addition to partnering with African financial institutions, the presence of Chinese financial institutions in Africa can provide a more solid foundation for corporate finance services to Chinese companies.

Of course, private enterprises also have their unique advantages in Africa. For example, private enterprises pay more attention to efficiency and long-term development. They are often quick in investment decision-making and flexible in personnel management.

But there is still a lot to be desired from them in terms of policy interpretation and social impact. Some of them no longer lack money, but experience and strategic cooperation. They hope to cooperate with state-owned enterprises and the China-Africa Development Fund to help them establish normal channels of contact with African governments.

Chinese private businesses should not rely too much on one single resource; they should also integrate more deeply into the local economic network, and provide more employment and training opportunities for locals.

Chinese goods have lowered the living costs of many local people. However, drawbacks such as weak awareness of environmental protection and social responsibility as well as shoddy products have, to some extent, diminished China's image.

In short, everything has its pros and cons. It is expected that with the transformation of China's economic growth mode, and the increasing enhancement of Sino-African economic cooperation, the positive impact will become increasingly larger.

The author is director of the Research Center for Small and Medium-sized Enterprises at the Chinese Academy of Social Sciences. The views do not necessarily reflect those of China Daily.

(China Daily 01/18/2013 page7)

Today's Top News

- Control of precursor chemical exports tightened

- Xi greets Ouattara on reelection as Cote d'Ivoire president

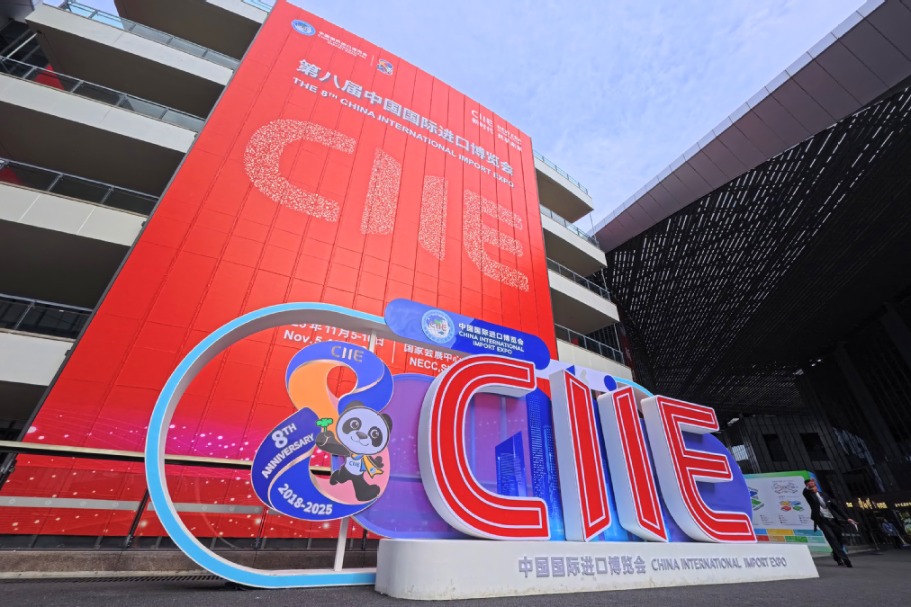

- CIIE displays innovation, global confidence in China

- Nation set to sharpen focus on key sectors

- Nation condemns Japan PM's remarks

- Spanish king on first state visit to China