IPO reform augurs well for investor confidence

The proposed IPO (initial public offering) reform is back in the news.

Unsurprisingly, the latest salvo was fired by the trade organization representing stockbrokers ahead of the hearing in the Legislative Council (LegCo) on Tuesday. The problem is that the brokers have failed to break new ground in objecting to the proposal.

But, there's nothing new in their latest manifesto apart from repeating the old argument that the proposed reform is unacceptable as it could undercut the authority and effectiveness of the stock exchange's listing committee. As a result, the initiative of vetting IPO applications and formulating listing policies would be transferred to the regulatory agency.

At the LegCo hearing, a representative of the Securities and Futures Commission contended that the aim of the reform was to facilitate and streamline the IPO approval process rather than an attempt to grab power, as suggested by some stockbrokers. He also refuted allegations that the reform plan contravened the securities ordinance.

It's not hard to understand why the stock-broking community is so dead set against the plan that seeks to establish a structure allowing regulators to be involved in the initial vetting process. Under the existing arrangement, the regulators have the veto power, but aren't involved in the process.

The proposed arrangement would enable the regulators to identify irregularities in the applications so that unqualified applicants can be weeded out during the vetting. But, critics of the reform insisted that the regulators have already had the power to block the listing of companies. For that reason, they questioned the need for change.

If that's the case, the more pertinent question is why are stockbrokers still arguing against the proposed reform which, according to them, would change nothing.

Critics also charged that the reform, if it goes through, would "chock off" market vitality and inhibit the market's development. That doesn't sound all that convincing. A well-regulated IPO market can only help to enhance investor confidence in Hong Kong as an international financial center.

| The Hong Kong security watchdog's proposal to tighten listing policies has run into strong opposition. However, experts believe it's a well-regulated listing mechanism that can lend greater support to the city's status as an international financial center. Provided To China Daily |

(HK Edition 04/21/2017 page9)

Today's Top News

- Control of precursor chemical exports tightened

- Xi greets Ouattara on reelection as Cote d'Ivoire president

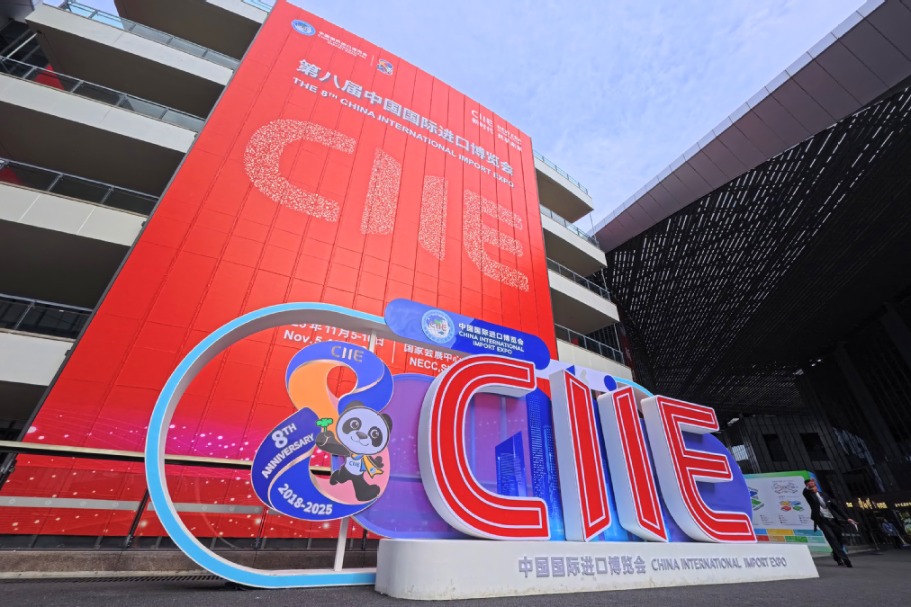

- CIIE displays innovation, global confidence in China

- Nation set to sharpen focus on key sectors

- Nation condemns Japan PM's remarks

- Spanish king on first state visit to China