'Dr Doom' highlights global financial risks

Veteran expert says China can learn from the mistakes of Western economies as it plays an increasingly influential role

Chinese financial institutions should become increasingly aware of global financial market risks and learn from the mistakes of Western counterparts, says Henry Kaufman, the former head of research at Salomon Brothers, the century-old Wall Street investment bank that was acquired by Citigroup.

Kaufman, who runs his own consultancy, Henry Kaufman&Co, also urges Chinese banks to increasingly focus on creating transparency and increasing disclosures about their key assets for international creditors, in order to exercise international leadership on financial governance.

"As China becomes, increasingly, a borrower in global markets, Chinese financial institutions should make more available data relating to the assets, the structure and maturity of their liabilities," Kaufman says.

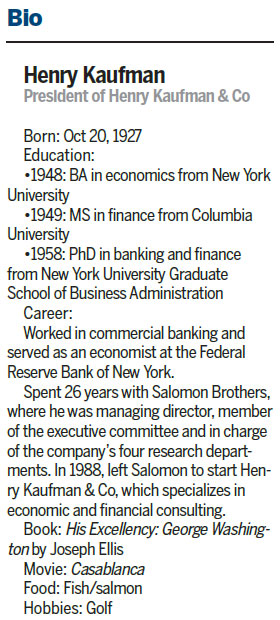

| Henry Kaufman, the former head of research at Salomon Brothers, and now the president of Henry Kaufman & Co, sees China's proposals and contributions in international financial governance as "a move in the right direction". Cecily Liu / China Daily |

The importance of financial information disclosure forms a key topic in Kaufman's latest book Tectonic Shifts in Financial Markets, which was published this year. In it, he explains how financial markets are still searching for their new bearings in the wake of the 2008 financial crisis.

Over-reliance on ratings agencies to provide adequate assessment of credit quality, especially of Western institutions, was a big contributor to the 2008 crisis, in Kaufman's view, and he believes this has changed very little for Western banks.

Kaufman, who was born in Germany in 1927, graduated with a PhD in banking and finance from New York University Graduate School of Business Administration in 1958.

During his 26-year career at Salomon Brothers, he witnessed how the bank became a major force in the money and capital markets by increasingly taking on risks, which also eventually contributed to his decision to leave the institution in 1988.

While working as chief economist at Salomon Brothers in the 1970s, Kaufman earned the nickname "Dr Doom" because of his frequent criticism of government policies. But he earned a lot of respect when his forecasts turned out to be accurate. For instance, on the morning of Aug 17, 1982, he accurately predicted that the market had bottomed out. That day, there was a huge rally in both stocks and bonds that led to the beginning of the longest bull market in history.

Kaufman's naturally cautious nature prompted him to continue to point out weaknesses and risks in capital markets. In his latest book, he highlighted alarming statistics, such as the fact that, in the mid-1980s, 61 nonfinancial corporations were rated AAA but today there are only two.

Other trends he has noted include that, in 1988, 35 percent of outstanding bond debt was rated BAA or lower. The percentage jumped to 47 percent in 1999, and 57 percent in 2014.

Meanwhile, companies have relied increasingly on debt in their financing strategies. During the 1990s, total company debt rose by $4.1 trillion (3.8 trillion euros; £3.2 trillion), compared with an increase in corporate equity of just $263 billion. Between 2000 and 2007, net equity levels actually contracted, while debt climbed another $7 trillion.

Kaufman highlights those as alarming signals of risks in our global financial system today and is urging Chinese banks to closely study the global financial system risks in the process of integration, to avoid the shocks European banks experienced in the 2008 financial crisis, which grew out of issues in the United States.

"Going back to 2008, the globalization of financial markets hurt European institutions and did not hurt China as much," says Kaufman. But as China becomes more integrated, it also takes on more risks.

In recent years, Chinese banks have increasingly expanded overseas to support Chinese companies growing into international markets, and to finance large overseas projects, such as infrastructure projects in the areas related to the Belt and Road Initiative.

China's overseas direct investment reached a record high of $145.67 billion in 2015, up by 18.3 percent from the year before, which made it the second-biggest globally, just behind the United States. China's total accumulated overseas direct investment by the end of 2015 amounted to $1.1 trillion, which was the world's eighth-largest.

By the end of 2015, more than 20 Chinese banks had set up about 1,300 outlets in 59 countries and regions overseas, according to data compiled by Bank of China. Last year, Bank of China was ranked China's biggest originator of overseas corporate loans, with 1.7 trillion yuan ($250 billion; 230 billion euros; £191 billion) in such lending, a 10.6 percent increase from the previous year.

Within this landscape of increasing Chinese participation in the international financial markets, China has also taken on a leadership role in championing global corporate governance.

For example, through its leadership at the G20 global leaders' summit last year, China worked with other G20 members to push forward financial governance, which led to discussions on strengthening the international financial structure, including recommendations, such as the broader use of the International Monetary Fund's Special Drawing Rights currencies, improving debt restructuring processes and advancing the IMF quota and governance reform.

Kaufman sees China's proposals and contributions in international financial governance as "a move in the right direction" and says China can best lead by example.

"Any contribution China can make in preventing future financial crises will be helpful, but China needs to set an example to avoid what happened in the post-World War II period, when we had a number of crises."

In his book, Kaufman references crises in the 20th century, such as the credit crunch of 1966, the dot-com bubble of 2000 and the 2008 financial crisis. Similarities in how excess credit drove each crisis, and the subsequent tightening and relaxing of credit that built up before the next crisis are studied closely in his analysis, highlighting the fundamental problem of financial markets - their short memory.

Another issue is the difficulty in balancing financial institutions' responsibility for providing the public with credit and entrepreneurial drive, which is still very much an unresolved issue for Western banks.

Kaufman sees US President Donald Trump's attempt to dismantle the strict financial regulation within the Dodd-Frank Act, replacing it with new policies to encourage economic growth, as dangerous.

"I think it's much too early to do that. We still have vivid memories of 2008," he says.

The Dodd-Frank Act, which was created as a response to the 2008 crisis with a focus on restraining banks from risk-taking and improving consumer protection, was considered the largest financial regulation overhaul since the 1930s.

Meanwhile, Kaufman says China's increasing participation in the global financial markets has huge implications for capital market participants and politicians globally.

He names China's financial market liberalization, renminbi internationalization and the country's accumulation of large foreign reserves as key examples.

"The Chinese currency has become an important currency in the financial markets of the world; therefore its movement is looked at more carefully. As China opens more, that will improve the flow of money globally," he says.

The renminbi's advance toward reserve currency status was significantly endorsed by its joining of the IMF's SDR basket of currencies in October. As of April, China's foreign exchange reserves stood at more than $3 trillion.

China has increasingly opened its domestic market to foreign participation in its onshore capital markets. For example, the Shanghai-Hong Kong Stock Connect established in 2014 allowed international investors to trade shares listed in China's domestic stock exchanges through Hong Kong, which is treated as an offshore financial market.

China last year also took several crucial steps to liberalize its domestic bond market for international institutional investors, and it expects a stronger overseas appetite due to diversified needs, especially when Chinese bonds become increasingly included in overseas bond indexes.

"China also plays an important role in the capital flows among nations," he says, adding that China-US relations are becoming increasingly important. He anticipates there will be more potential for cooperation.

cecily.liu@mail.chinadailyuk.com

(China Daily European Weekly 05/19/2017 page32)

Today's Top News

- Lai's 'separatist fallacy' speech rightly slammed

- Xi's message for New Year widely lauded

- Swiss bar fire kills around 40, injures more than 110

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency