Risk with Chinese debt under control: Finance Minister

Risk associated with Chinese government debt is under control, said Minister of Finance, Liu Kun on Thursday.

China's government debt stood at 33.35 trillion yuan ($4.97 trillion) by the end of 2018, 37 percent of the country's GDP, significantly lower than the EU warning line of 60 percent, Liu said.

The ratio was also lower than both major market and emerging economies.

"As for implicit government debt, we have taken stringent measures to avoid new implicit debt from taking place," Liu said, adding that progress has been made resolving risk with existing implicit debt.

The ministry will continue to forestall and defuse risk arising from implicit debt, cracking down on violations of laws and regulations, as well as pushing reform of financing companies, Liu said.

Liu made the remarks at a news conference from the sidelines of the annual two sessions.

The Government Work Report delivered on Tuesday set this year's national quota of local government special-purpose bonds at 2.15 trillion yuan, 800 billion yuan more than last year, with some issued and snapped up by investors.

Liu said money raised will primarily be spent on major projects currently underway and addressing weak links.

Liu specifically outlined three key areas: the battle against poverty and pollution; major development work such as the Xiongan New Area, and other projects, such as shantytown renovation and the construction of transport infrastructure.

The Ministry of Finance strives to ensure bonds fulfill their function stabilizing the economy as soon as possible, Liu said.

"At present, the money raised by local governments has been put into projects only several days after the issuance, therefore playing a notable role in stabilizing investment, encouraging consumption and addressing weak links."

- 'Book of Songs' from Chinese imperial tomb proves oldest complete copy ever found

- Exhibition highlighting the 'Two Airlines Incident' opens in Tianjin

- Average life expectancy in Beijing rises to 83.93 years

- Energy drink overdose sends delivery worker to hospital

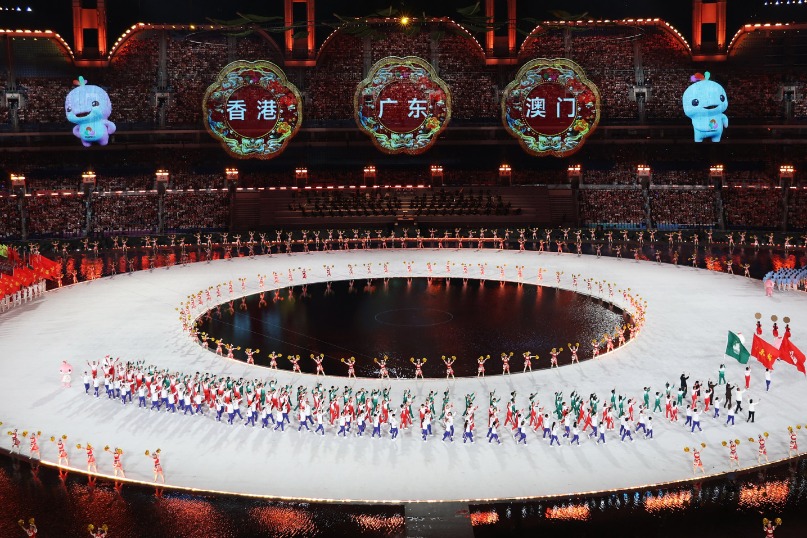

- GBA and Hainan deepening cooperation to boost innovation and sustainable growth

- Beijing mulls including the costs of embryo freezing and preservation in medical insurance