PBOC says monetary policy to stay normal 'as long as possible'

China's central bank reiterated its intent to maintain a "conventional monetary policy as long as possible", while keeping certain policy adjustment space to encourage moderate savings and prevent asset bubbles.

The tone was evident in an article authored by a research team of the central bank's general administration department and published in the latest issue of China Finance, a magazine run by the People's Bank of China, the central bank.

The article summarized the framework of China's "modern central bank system". The idea behind such a system is to implement the decisions of the Fourth Plenary Session of the 19th Central Committee of the Communist Party of China (CPC) held in October 2019.

The framework is composed of four parts: improve the monetary policy decision-making and implementation mechanism; improve the macro-prudential policy framework; establish modern financial infrastructure and a financial service system under the central bank; and promote a monetary and fiscal policy coordination mechanism and the central bank's financial budget management system, according to the article.

The ultimate objective of China's monetary policy is "to maintain the stability of currency value and promote economic growth", it said.

The monetary policy should also focus more on structural and employment objectives, to smooth its transmission mechanism and enhance the interest rate corridor framework. Financial institutions are encouraged to support private, small and micro enterprises, the article said.

The basic tone of the PBOC has remained unchanged, before or amid the novel coronavirus pandemic even as major central banks around the world announced an array of measures, which included slashing policy rates to near-zero, launching asset-purchase programs and expanded currency swap lines to limit economic fallout and address the market turmoil.

At a time when global monetary authorities are easing monetary policy and the domestic liquidity remains reasonably ample, China needs to further increase the money and credit supply, and to lower the lending rate by cutting the policy interest rates, said Zhang Xiaohui, a senior researcher of the China Finance 40 Forum, and a former assistant governor of the PBOC.

The article has suggested the need for an efficient coordination mechanism for the monetary and fiscal policies. But it highlighted that the modern central bank system "strictly prohibits the government from overdraft to the central bank", and the "two pockets of funds" should never be mixed up.

That means the government should not be allowed to print unlimited money, even during an emergency. Budget control and debt management are part of the basic rules of the fiscal policy, said experts.

"China has enough policy reserves of conventional measures and does not need to follow some advanced economies to enact nonconventional measures, such as zero interest rate or even negative interest rate," said Dong Jinyue, China economist of Banco Bilbao Vizcaya Argentaria, a Spanish bank.

"A positive interest rate is in line with China's potential growth and prevents the run-up of asset bubbles. Moreover, a positive interest rate encourages household savings and helps to maintain financial stability," Dong said.

Given the nature of the COVID-19 shock, a good strategy is to be more cautious about interest rate cuts while being more proactive in using liquidity management tools, said the BBVA economist.

The PBOC is scheduled to cut the targeted required reserve ratio on May 15, by 0.5 percentage point, to inject liquidity to the financial sector and lower financing costs.

Today's Top News

- China-Cambodia-Thailand foreign ministers' meeting held, press communique issued

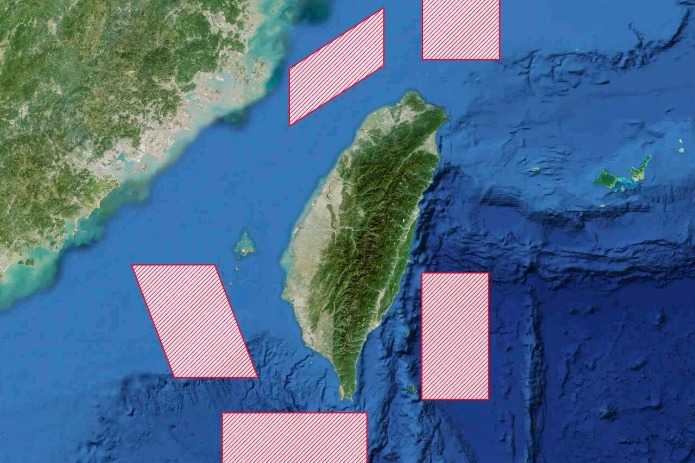

- Drills demonstrate China's resolve to defend sovereignty against external interference

- Trump says 'a lot closer' to Ukraine peace deal

- China pilots L3 vehicles on roads

- PLA conducts 'Justice Mission 2025' drills around Taiwan

- Partnership becomes pressure for Europe