Experts: Policy tools should target easing of deflation risks

China still has adequate space to stimulate growth via monetary actions as inflation pressure is slowly easing, and bulk of its efforts should be aimed at curbing deflation amid weak external demand, experts said on Thursday.

Falling oil and commodity prices, largely due to the novel coronavirus outbreak, could lead to further price declines in industrial goods and depress manufacturing, they said.

According to Nomura Securities, China's Consumer Price Index and Producer Price Index may decline in April, while outstanding credit growth could rise further due to the policy stimulus for combating the COVID-19 pandemic.

The Japanese securities firm said growth of RMB loans may slow down in April from the record high of 2.85 trillion yuan ($401.9 billion) in March, as economic recovery in China may face external headwinds.

The official inflation and credit data are expected to be announced next week. According to the National Bureau of Statistics, prices of industrial products fell by 1.5 percent on a yearly basis in March, the 10th consecutive month of contraction. Consumer inflation also declined for two months in a row after hitting a high of 5.4 percent in January.

Steven Cheung, an economist in Hong Kong, said on Thursday that China needs to prevent "debt-deflation"-a theory initiated by Irving Fisher in 1933 amid the Great Depression. The essence of Fisher's debt-deflation theory was an interactive process whereby falling asset prices increased the debt burden of borrowers.

"Due to the economic fallout from the COVID-19 epidemic, the upper limit for China's inflation target could rise to 6 percent," said Cheung. The People's Bank of China, the central bank, is capable of adjusting the monetary policy targeting a certain range of the price index, he said, adding that the inflation target can be scaled down later, so as to temper hyperinflation expectations.

A lower inflation rate also leaves more space for the central bank to adopt monetary policy easing. Economists expect the PBOC to inject more liquidity into the banking system via reserve requirement ratio cuts and various lending facilities, such as the medium-term lending facility and re-lending.

The central bank may also deliver more rate cuts, including a cut in the one-year benchmark deposit rate, to meet policymakers' requirements of saving jobs and rescuing smaller businesses, analysts said. Lower interest rates will help create a favorable financing environment for further bond issuance, they said.

Additional policy moves are likely to be enacted after the annual meeting of the National People's Congress, China's top legislature, which will convene starting May 22. Economic targets for this year, such as GDP growth and inflation, may be announced during the meeting and it may also give hints about the monetary and fiscal response to achieve the goals.

The State Council held an executive meeting on Wednesday, chaired by Premier Li Keqiang. The meeting pledged to unveil new policies according to the changing economic environment. Small and micro companies, as well as self-employed people, can delay tax payments. The exemption period for value-added tax of transportation and express delivery services will be extended.

It has called for policy tools to help banks issue more credit loans. Small businesses in financial difficulties can avail loans or delay repayment of principal and interest, said a statement.

China will also raise the front-loaded quota of local government special bonds by another 1 trillion yuan. Issuance of the increased quota should be finished by the end of May, according to the meeting. Most of the debt is for infrastructure construction projects, and local governments have already issued 1.29 trillion yuan of special bonds this year.

Today's Top News

- China to apply lower import tariff rates to unleash market potential

- China proves to be active and reliable mediator

- Three-party talks help to restore peace

- Huangyan coral reefs healthy, says report

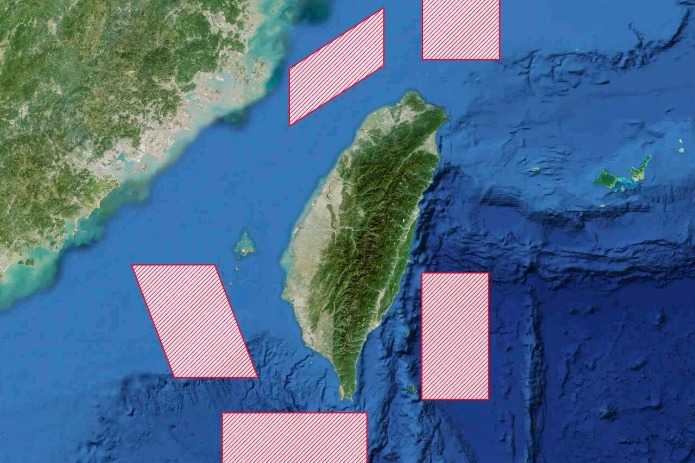

- PLA conducts major drill near Taiwan

- Washington should realize its interference in Taiwan question is a recipe it won't want to eat: China Daily editorial