Regulator urged to speed up bank IPO clearances

China should accelerate banks' initial public offerings so that small and medium-sized commercial lenders can raise funds from capital markets and better serve small businesses, experts said.

"Initial public offerings are crucial channels for banks to replenish capital," said Dong Ximiao, chief analyst of XWBank, an online-only bank based in Sichuan province. "Although some banks are facing higher downward pressure on asset quality and a higher possibility of nonperforming loan explosion, the securities regulator should treat different banks differently and support those banks with good asset quality, clear core business and stable development to launch IPOs."

No bank listed in the Chinese mainland and Hong Kong during the first six months of this year. The stagnation of bank IPOs may largely be due to regulatory consideration to stabilize capital markets, since banks raise a huge amount of funds and the same will affect the listing of other companies, Dong said.

"Another reason behind the stagnation of bank IPOs is that nowadays the banks seeking to be listed are mainly small and medium-sized commercial lenders whose growth remains uncertain amid the economic downturn and the novel coronavirus outbreak …However, the state of operation varies from one bank to another, and the asset quality of some small and medium-sized banks is still very good," he said.

As of July 2, 19 banks including Bank of Guangzhou Co, Chongqing Three Gorges Bank Co and Shanghai Rural Commercial Bank Co were waiting to be listed on the A-share market. By Wednesday, another four banks including China Bohai Bank Co were waiting for IPOs on the Hong Kong stock exchange.

China Bohai Bank, a national joint-stock commercial lender based in Tianjin, is seeking to raise HK$13.68 billion ($1.77 billion) to HK$14.34 billion through a listing in Hong Kong on July 16. It will offer 2.88 billion H shares in the global offering, and the offer price is currently expected to range from HK$4.75 to HK$4.98 per share, the bank said in an announcement on June 30.

Its nonperforming loan ratio was 1.77 percent by Sept 30, down 7 basis points from 1.84 percent at the end of 2018. During the same period, its core tier-1 capital adequacy ratio dropped from 8.61 percent to 8.17 percent.

Apart from China Bohai Bank, Dongguan Rural Commercial Bank Co, Weihai City Commercial Bank Co and Xinjiang Huihe Bank Co are also waiting to be listed in Hong Kong.

Wen Bin, chief analyst at China Minsheng Banking Corp, said stricter examination of listed banks' corporate governance may have affected bank IPOs this year. Besides, changes in banks' profitability are likely to take place. This will also affect the speed of the IPO progress.

Another reason behind the stagnation of bank IPOs is that bank stocks are currently undervalued, experts said.

Among 36 A-share listed banks, investors saw a decline in stock prices of 21 of them from the beginning of this year till Thursday. In addition, the price-to-book ratio, which measures a company's market value relative to its book value, of 25 A-share listed banks fell below 1, according to Wind, a financial data provider in China.

"Under the circumstances of economic downturn, it is quite normal for the P/B ratio of a bank to be less than 1. As bank stocks are clearly undervalued, it is safe to invest in bank stocks. Theoretically, investors will recoup their investments from the sale of net assets of a bank even if it goes bankrupt, not to mention that they will receive relatively high dividends which should be valued by long-term investors," Dong said.

Today's Top News

- China Daily launches 'China Bound' — a smart-tourism service platform

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan

- Ties with Russia expected to bear fruits

- Confidence, resolve mark China's New Year outlook

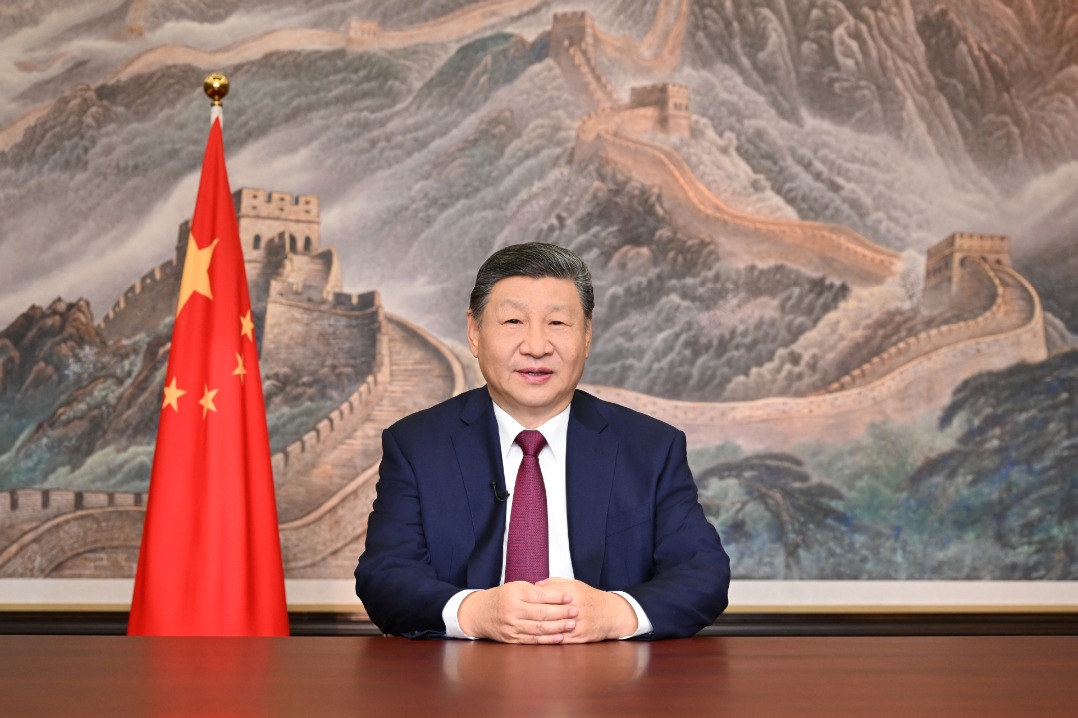

- Xi urges solid work for more progress