Six things to watch in China's economy

Business expectations

China's business confidence has largely improved this year. But the sentiment still diverged in different sectors as lingering epidemic impacts and external changes exacerbated the difficulties facing micro, small, and medium-sized enterprises.

Analysts said building the confidence of various business entities, including private enterprises, is crucial to promoting a sustained economic recovery.

China has carried out a raft of measures to reassure entrepreneurs, including removing more barriers in market access, further reducing taxes and fees to save 1.8 trillion yuan for businesses this year, and boosting financial support for agriculture and rural areas as well as micro, small and private firms.

Recently, authorities issued a guideline to improve the growth of the private economy, promising to improve the business environment, enhance policy support, and strengthen the legal guarantee for its development.

The market confidence is expected to be further enhanced, Liu Xiangdong, a researcher with the China Center for International Economic Exchanges (CCIEE) said, citing effective policies to promote economic recovery, continuous improvements to a market-oriented, law-based, and internationalized business environment, and targeted relief measures to tackle businesses' difficulties.

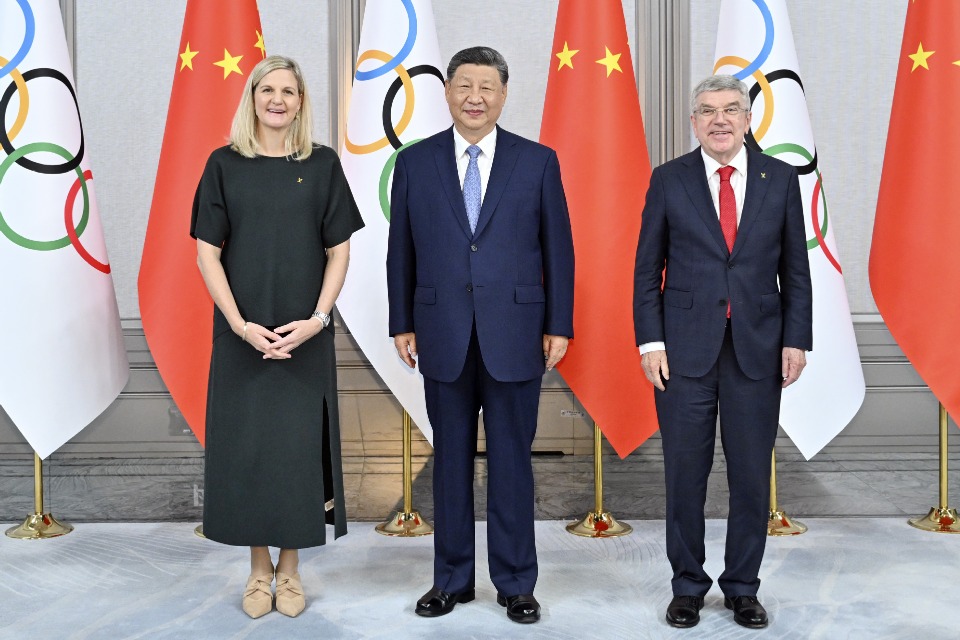

Since the beginning of this year, multiple visits to China by executives of multinationals, including Tesla, J.P. Morgan Chase, and Apple, have already cast a vote of confidence in China's economic outlook.

As the Chinese economy has kept its recovery momentum this year with increasing production and unleashed pent-up demand, businesses can seize the opportunity to bolster strength and gear up for future development, analysts said.

Defusing risks

For the world's second-largest economy, lurking risks and hidden dangers in the property sector, local government debts, and some smaller financial institutions are among the challenges adding uncertainties to its recovery.

Despite being largely stable, China's real estate market has faced multiple challenges, with a dawdling recovery and dented confidence of developers and home buyers.

Targeted policy measures were rolled out to meet the challenge. China's financial authorities have announced the extension of credit support to ensure the delivery of pre-sold homes. Over 100 cities have taken city-specific measures such as lower lending rates and looser restrictions to spur house purchasing.

"There is no systemic risk in the real estate sector, but the existence of supply-demand imbalance entails structural reforms in the long run," said Zhu Min, vice chairman of the CCIEE.

The country has done a lot to prevent and defuse risks in small and medium-sized financial institutions, which face increased operating pressure and concentrating regional risks.

By promoting restructuring and market exits, the Chinese financial regulator has managed to help some small lenders revive and significantly reduce the number of high-risk institutions. More will be done to advance mergers and acquisitions of smaller banks, improve the corporate governance of financial institutions, and give full play to the fund for ensuring financial stability.

The issue of local government debts also came under the spotlight recently.

While most of the provincial regions reported positive growth in fiscal revenue in the first quarter, local governments will likely retain a tight balance in their budgets due to lingering epidemic impacts and rising spending in key areas.

In response, China is weaving a stronger safety net against debt risks, with measures to tighten oversight, strictly implement lifelong accountability, and strengthen regulation over local government financing vehicles.

Generally speaking, the fiscal condition in China is safe and healthy, leaving ample leeway for dealing with risks and challenges, the Ministry of Finance has said, pledging to ensure the bottom line of no systemic risk.