Dual-track approach to aid currency

Use of digital yuan, stablecoins urged to strengthen monetary position

As global currency competition intensifies in the digital space, Chinese economists are urging a dual-track approach to strengthen China's monetary position — leveraging both central bank digital currency innovation and stablecoin development, with a clear eye on the future of cross-border payments and digital asset ecosystems.

They have pointed to the need to break a structural limitation of China's CBDC, or the digital yuan — its monetary classification as M0 or essentially cash equivalents — to expand its usage scenarios, especially in cross-border business-to-business transactions.

Stablecoins are a type of cryptocurrency pegged to fiat currencies or other real-world assets at a designated exchange rate to maintain a stable value.

Zhang Ming, deputy director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, said China could take a "two-pronged approach" in response to the potential impact of US dollar stablecoins on the international monetary system — advancing the digital yuan, also known as the e-CNY, while developing offshore renminbipegged stablecoins.

According to Zhang, the biggest constraint on the digital renminbi is that it has been designed to function only as M0 to limit the impact on the banking system, meaning it can substitute cash and is mostly used in merchant-to-individual transactions, with limited application in business-to-business or interbank dealings.

"To accelerate the development of the digital renminbi, its substitution level should be raised from replacing M0 to M1 or even M2, which would broaden its application scenarios, especially overseas," he said.

In general, M0 refers to currency in circulation, M1 includes M0 plus demand deposits, and M2 includes M1 plus time deposits. The higher the category, the broader the range of funds covered and the more diverse the potential use cases.

Zhang suggested piloting offshore renminbi stablecoins in the Hong Kong Special Administrative Region and Shanghai's Lin-gang Special Area, using them to facilitate overseas trade and investment settlements for Chinese companies and to act as a bridge connecting on-chain and off-chain financial transactions, paving the way for real-world asset development.

To maintain the effectiveness of China's cross-border capital movement, any move to develop the onshore renminbi stablecoin market should be considered cautiously, while the offshore market can take the lead, he added.

Major economies are accelerating their frameworks for stablecoin oversight, with the Stablecoins Ordinance having commenced operation in the Hong Kong SAR on Aug 1, introducing a high-threshold licensing regime.

The United States, through the GENIUS Act, has established a dual federal-state regulatory system, while the European Union's Markets in Crypto-Assets Regulation has set regional entry thresholds.

Echoing Zhang's views, Li Lihui, former president of the Bank of China and a leading expert on digital finance, suggested expanding the digital yuan from mainly retail payment use to wholesale transactions serving corporate clients.

Moving further from retail to wholesale could offer much greater market potential and would require evolving the digital yuan from M0 toward M1 and even M2, said Li, who also underscored the importance of facilitating the cross-border development of the digital yuan, highlighting the central bank's plan to set up a digital yuan international operations center.

At the 2025 Lujiazui Forum in June, China unveiled a raft of new opening-up measures, including setting up an international operation center for the e-CNY and the development of offshore bonds in Shanghai.

"China's demand for cross-border payments is growing rapidly, and many of our cross-border platforms such as JD and Ant Group have been successful. Further advancing the global application of the digital yuan will be critical to enhancing the renminbi's international influence," Li said.

Today's Top News

- China to apply lower import tariff rates to unleash market potential

- China proves to be active and reliable mediator

- Three-party talks help to restore peace

- Huangyan coral reefs healthy, says report

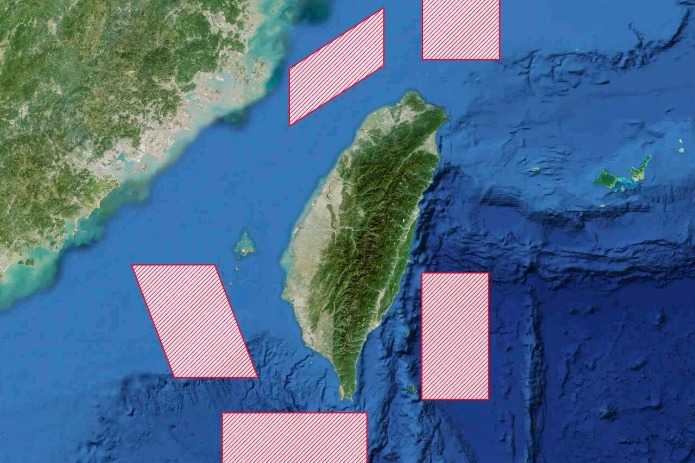

- PLA conducts major drill near Taiwan

- Washington should realize its interference in Taiwan question is a recipe it won't want to eat: China Daily editorial