|

BIZCHINA> Center

|

|

Related

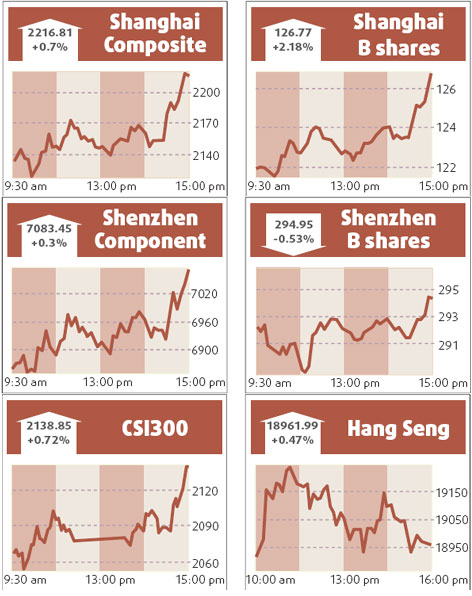

Stocks edge up 0.7% as rally loses steam

(China Daily/Agencies)

Updated: 2008-09-25 10:36

Chinese stocks closed up 0.7 percent yesterday, reversing early losses as institutional investors bought large-caps such as China Unicom in late trade in an apparent response to a government appeal to support the market. The benchmark Shanghai Composite Index ended at 2216.811 points, compared with an intraday low of 2116.960 hit in early trade, when it was down 3.84 percent. Gaining Shanghai stocks outnumbered losers by 714 to 206, while turnover in Shanghai A shares shrank to 48.90 billion yuan from Tuesday's 77.32 billion yuan. China Unicom closed up 7.72 percent at 5.3 yuan. Institutions selected China Unicom after Deutsche Bank upgraded its similarly named Hong Kong indirect subsidiary to "buy" from "hold". The index soared a total 18 percent on Friday and Monday, buoyed by a government rescue plan that included abolishing the tax on share purchases and having Central Huijin, an arm of China's sovereign wealth fund, buy shares from the market. But the rally appears to have lost some steam, with the stock index dropping 1.56 percent on Tuesday, amid concerns that the government fund may not continuously buy stocks if stock prices reach higher levels. Investors are also concerned that the outlook for the proposed $700 billion US financial rescue scheme has now become more cloudy because of the disagreement in the US Congress. "Institutional investors bought late in the session today, apparently aimed at bolstering shaky sentiment," said senior stock analyst Chen Jinren at Huatai Securities. "If the government and their entities continue their efforts to boost the market, share prices should be able to stage another several rounds of rebounds in the medium term," he said. Analysts, however, said that any decent rebounds should come only after the week-long National Day holiday next week as quite a large number of traders and investors have already returned to their homelands for the so-called "Golden Week" break. Top lenders Industrial and Commercial Bank of China (ICBC), Bank of China and China Construction Bank (CCB) said on Tuesday that Central Huijin had bought 2 million Shanghai-listed shares in each of the banks. But the news did not support the stocks, partly because the size of the purchases was so small compared to the banks' size ICBC, for example, has 334 billion Shanghai-listed shares.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 济南市| 白朗县| 福州市| 南澳县| 北辰区| 汶川县| 小金县| 中阳县| 临泽县| 普格县| 香格里拉县| 临夏县| 墨江| 文成县| 黄梅县| 大悟县| 兴化市| 阿拉善左旗| 吴堡县| 遂溪县| 无锡市| 尼勒克县| 南川市| 朝阳县| 新津县| 泾阳县| 土默特左旗| 忻城县| 衡水市| 嘉兴市| 福建省| 金乡县| 太康县| 鄂州市| 连州市| 高清| 太湖县| 太白县| 禄丰县| 刚察县| 扬州市| 隆昌县| 汽车| 乌兰浩特市| 大同市| 东海县| 郸城县| 安龙县| 准格尔旗| 卫辉市| 资兴市| 华容县| 东莞市| 荣成市| 锡林郭勒盟| 天津市| 同江市| 甘肃省| 林州市| 天水市| 德昌县| 海晏县| 丰宁| 四平市| 齐齐哈尔市| 江华| 行唐县| 大名县| 桑植县| 乐平市| 旌德县| 琼中| 宜君县| 苏尼特左旗| 叙永县| 洛南县| 扬州市| 公安县| 闸北区| 土默特右旗| 乌兰县| 绵阳市|