China is expected to see the amount of new loans in the country increase at a slower pace in June, raising economic uncertainties and strengthening doubts about whether the economy will pick up in the second half of the year.

China's Big Four banks issued 180 billion yuan ($28.3 billion) worth of new loans last month, the Shanghai Securities Journal reported on Tuesday, citing an anonymous source. Although the People's Bank of China, the country's central bank, has yet to issue official figures, that number is believed to be down by 28 percent from the 250 billion yuan in new loans the four banks issued in May.

The Big Four banks - Bank of China Ltd, China Construction Bank Corp, Industrial and Commercial Bank of China Ltd and the Agricultural Bank of China Ltd - typically make from 30 percent to 40 percent of the country's newly added loans.

If the percentage remained in that range in June, then banks are likely to have loaned far less than the 950 billion yuan to 1 trillion yuan the market expected.

"There continues to be a lot of fluidity, but companies lack the confidence they need to expand their production and still have concerns about weak external and internal demand," said Zhao Xijun, deputy head of Renmin University of China's School of Finance.

The dim outlook for other places in the world - the product of a lingering downturn in the United States and Europe and weaker growth in emerging economies since the second quarter of the year - has affected China's exports and export-driven investments.

The demand for loans has also decreased as the country works to have its economy driven more by consumption and less by big construction and infrastructure projects.

Overcapacity has helped make lending less common. And the real estate industry, often the recipient of many loans, remains in a downturn.

The seasonally adjusted Chinese purchasing managers' index fell to 50.2 in June, suggesting that factories are producing less.

The banking industry, for its part, has expressed intentions to submit to stronger regulation and to be more cautious about issuing loans. Much bad debt has been the result of the frequent lending of previous years, as well as of huge government investments in infrastructure, Zhao said.

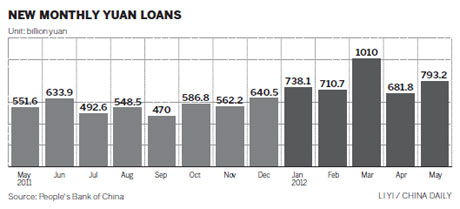

Chinese lenders made 2.46 trillion yuan worth of new loans in the first quarter of the year, an increase of 217 billion yuan year-on-year.

The amount of new loans issued in May increased by a stunning 111.4 billion yuan from April, making it almost inevitable the number would decline in June, said Yin Zhongli, a senior researcher with the Chinese Academy of Social Sciences' Financial Research Institution.

Yin said a single month's figure doesn't carry a lot of significance. He said the economic downturn will last for a few years and the economy is unlikely to bottom out in the second quarter, as some economists forecast it would.

But there are reasons for optimism, said Zhang Zhiwei, chief economist for China at Nomura Holdings Inc.

The country is moving faster to loosen its fiscal policies and to reduce interest rates more than market observers expected.

Zhang said many are still convinced the economy bottomed out in the second quarter and could move upward in the second half of the year.

lanlan@chinadaily.com.cn