Changes in VAT will benefit some companies but hurt others: Experts

It has been quite a busy month for Su Chenhui, financial manager at LabCorp Clinical Trials, but more challenges seem to lie in the months ahead.

To prepare his company for the value-added tax reform that will become effective on Sept 1, Su has been sent to two training sessions organized by the local tax bureau and his tax adviser.

What Su has learned was that there might be more paperwork to deal with, tougher supervision from authorities and the possibility of renegotiating contracts with clients of his company, a Beijing-based US medical test service provider.

Fortunately, however, all the hard work will pay off once his company adopts VAT instead of business tax.

"Under the new system, the company will be eligible for a deduction of 17 percent VAT in our material costs, mainly reagent in our case, which accounted for about 40 percent of our revenue.

"That will translate to a saving in taxation equivalent to 6.8 percent of our revenue, which is even more than the 6 percent VAT we are required to pay," Su said.

LabCorp's case is not unique, as the policy will also benefit 138,000 other corporate taxpayers in modern-service and transportation sectors that will be involved in the tax reform in the capital city.

Instead of paying business tax on all transactions in the industrial chain, modern service providers will pay 6 percent VAT. Transporters will be charged 11 percent VAT. Both levies are deductible with the input tax receipt from their suppliers.

According to a statement from the local tax authorities, the program is expected to save Beijing's businesses 16.5 billion yuan ($2.6 billion) a year.

"As for our company, it is reflected in a lower break-even point," Su said.

"We would have to achieve at least 24 million yuan annual sales before starting to make profits if still paying business tax but, under VAT, the company could start making money at 20 million yuan sales."

Backed by the favorable conditions, LabCorp Clinical Trials Beijing is expecting a 15 percent growth in annual revenue, according to the financial manager.

This is exactly the result policy makers want to see when they pushed forward VAT reform in the first place. Later it will be expanded across eight other provinces.

Booster of confidence

Business tax applies to a production process, with the tax rates varying from 3 to 15 percent according to different sectors, while VAT is deduced from the difference between a commodity's price before taxes and its cost of production.

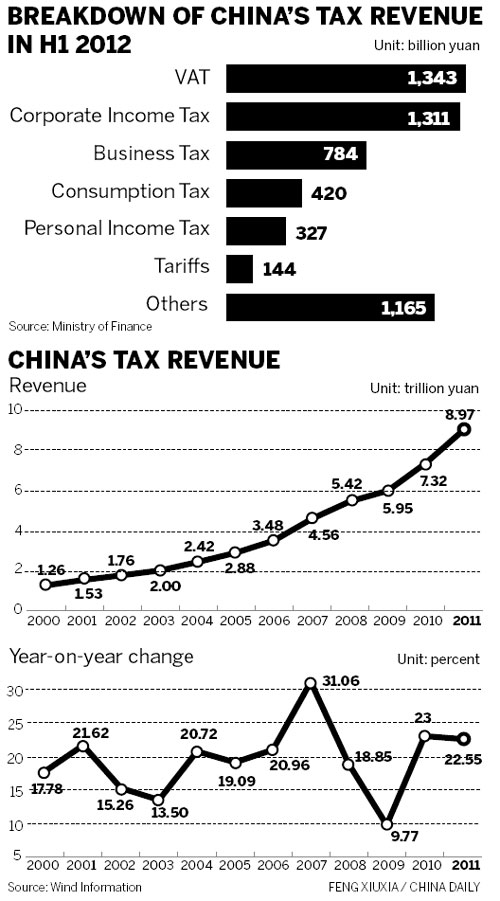

VAT and business tax together accounted for more than 50 percent of China's tax revenue in 2011.

Following Beijing on Sept 1, VAT will be further applied to the transport sector and some modern service industries, replacing business tax, in the provinces of Jiangsu and Anhui on Oct 1, Fujian and Guangdong on Nov 1 and Tianjin, Zhejiang, and Hubei on Dec 1.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions