In the meantime, China's current macroeconomic policy is much more focused on supporting domestic demand than exports, as the real estate downturn continues to dampen growth, which may now drop to a historical low.

Zhu Jianfang, chief economist at CITIC Securities Co Ltd, says that China may retain its targeted easing in monetary policy in 2015 to avoid a hard landing of the real economy, with the possibility of further cuts in both the bank reserve requirement ratio and benchmark interest rates.

Given the current sluggish economy, the central bank remains under pressure to bring down financing costs for business borrowers and lower the interbank interest rates.

A research note from JPMorgan Chase & Co has said that the PBOC could make two RRR cuts of 50 basis points each in 2015 to stabilize broader money supply, or M2 growth, which will be accompanied by targeted quantitative easing.

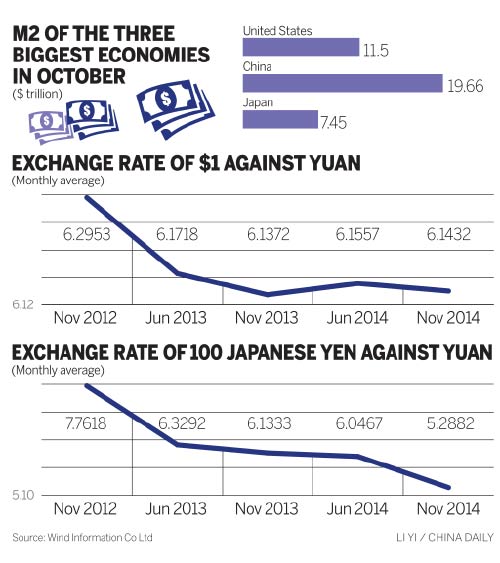

Wang Tao, chief economist in China at UBS AG, says that narrowing interest rate differentials and increasing capital outflows can help drive the yuan modestly weaker against a strengthening dollar amid heightened volatility.

"Although the government wants to avoid exacerbating economic imbalances with an excessively expansionary monetary policy, it also needs to prevent passive tightening in light of slower foreign exchange inflows and tightening shadow banking rules," she says.

China's exchange rate policy may become more flexible next year as the internationalization of the yuan is accelerated, says Zhou Shijian, a senior trade researcher at the Center for US-China Relations at Tsinghua University.

The yuan is likely to be a part of the IMF special drawing rights' basket by 2020, by which time the capital account will be fully opened to the international market and the currency will be freely exchanged, so monetary policy should start preparing for that from now, says Zhou.

Lian Ping, chief economist with the Bank of Communications, says that in the near future, both capital inflows and outflows will be seen, and cross-border funding flows will become more volatile.

"The current environment is complicated," says Lian.

Besides the effects of an end to the United States' quantitative easing, the pressure on domestic companies to boost direct overseas investments and measures to lower internal market interest rates will together affect capital flows, he says.

"As Chinese economic growth enters a structural downturn and the international payments surplus narrows, the growth in China's foreign exchange purchases is expected to slow down in the medium term."

As the country's trade surplus rises and domestic investment slows, China is likely to generate large current account surpluses over a prolonged period.

The large scale of surpluses will then transform into capital outflows and be injected into global infrastructural investments.

"China's fund outflows may keep long-term capital cheap even if the world's major central banks tighten their monetary policies. How the world absorbs China's large current account surpluses will define the next round of economic expansion," says Sanjeev Sanyal, global strategist at Deutsche Bank.

He said that a real appreciation of the yuan is unlikely to correct those surpluses, but could perversely add to them.