|

|

|

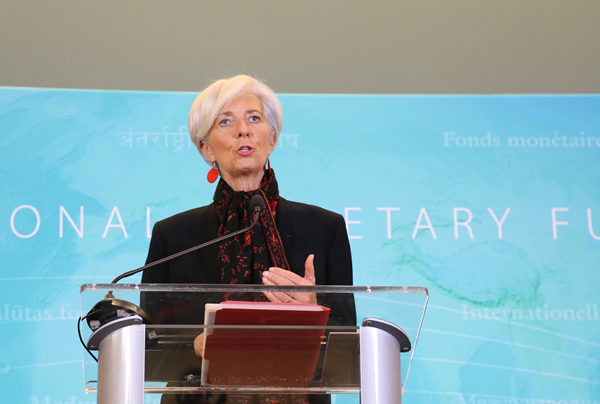

Christine Lagarde, managing director of the International Monetary Fund (IMF), announced on Monday noon that the IMF Executive Board, which convened in the morning, has voted to include the Chinese currency, RMB, into IMF's SDR (Sprecial Drawing Right) basket. Chen Weihua/China Daily |

The decision on Monday by the International Monetary Fund (IMF) Executive Board to include the Chinese currency RMB into its Special Drawing Rights (SDR) basket has won widespread applause.

IMF Managing Director Christine Lagarde announced the decision on Monday noon after the vote by its executive board.

She said the board decided that RMB met all existing criteria and, effective Oct 1, 2016, the RMB is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency, along with the US dollar, the euro, the Japanese yen and the British pound.

She explained that the date of launching the new SDR basket next October is to provide sufficient lead time for the IMF, its members and other SDR users to adjust to these changes.

Lagarde called the decision "an important milestone in the integration of the Chinese economy into the global financial system."

"It is also a recognition of the progress that the Chinese authorities have made in the past years in reforming China’s monetary and financial systems," she told reporters in a briefing at IMF headquarters in Washington.

"The continuation and deepening of these efforts will bring about a more robust international monetary and financial system, which in turn will support the growth and stability of china and the global economy," she added.

SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries’ official reserves. SDRs are allocated to IMF members from time to time, based on each country’s quota in the IMF. A total of 204.1 billion SDRs have been allocated to date, most recently in 2009 when SDR 182.6 billion was allocated.

The People’s Bank of China (PBOC), the central bank, said it welcomes the IMF decision, calling it an acknowledgement of China’s economic development, reform and opening up.

"The inclusion of the RMB in the SDR basket will increase the representativeness and attractiveness of the SDR, and help improve the current international monetary system, which will benefit both China and the rest of the world," it said in a statement after the IMF announcement.

"It also means that the international community expects China to play a bigger role in the international economic and financial system," the statement said.

The PBOC said China will continue to deepen and accelerate economic reforms and financial opening up, and contribute to promoting world economic growth, safeguarding financial stability and improve global economic governance.

Eswar Prasad, a professor at Cornell University and a senior fellow at the Brookings Institution, said the RMB’s elevation to the club of elite global reserve currencies is a big step for China and a significant one for the international monetary system.

"It is a historic moment in international finance for an emerging market economy, with a per capita income barely a quarter that of other reserve currency economies, to be anointed as the issuer of one of the world’s major reserve currencies," said Prasad, a former IMF chief in China.

Prasad called the decision "an important validation of China’s efforts over the past year to liberalize financial markets, open up its capital account, and allow its currency’s value to be determined to a greater extent by market forces."

"The IMF’s positive decision will strengthen the hands of economic reformers in China and could help sustain momentum on financial sector liberalization and reforms. However, the domestic opposition to further financial sector reforms and market-oriented liberalization measures remains fierce, and this decision by itself is unlikely to shift the balance substantially," he said.

In a background briefing, IMF officials have refuted critics who described the IMF decision as "political and bending the rules."

Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, also said he sees no evidence that the IMF bent any rules.

"China addressed all of the operational issues that were raised by the IMF in its review this summer so approval today was a foregone conclusion in my view," he told China Daily on Monday.

"The inclusion of the RMB in the SDR basket is a big step further forward in the internationalization of the RMB and will pave the way for the emergence, over time, of RMB-denominated assets comprising a significant share of global reserves" said Lardy, an expert on the Chinese economy.

Kamel Mellahi, a professor of strategy at Warwick Business School, called the IMF decision "a huge symbolic victory for China, but [one that] comes with strings attached to it."

"China has been loosening its tight grip on the management of the yuan for a while, but now the PBOC is going to come under immense pressure to be more transparent and improve its way of communicating with international markets. This requires massive cultural and procedural changes," he said.

Ji Mo, chief economist of Asia ex-Japan Amundi Hong Kong Ltd, said SDR inclusion will accelerate RMB internationalization.

"One important aspect of RMB internationalization is the further liberalization of the capital account, meaning the RMB exchange rate will have to move toward a more flexible regime," he said.

He expected a more market-based monetary policy framework with operations targeting short-term interest rates and a better transmission mechanism will be the direction.

Desmond Fu, a trader at Western Asset, said the IMF decision marks recognition of RMB’s rising role in global financial markets, both as a reserve currency and as a settlement currency.

"This is beneficial to both China and its trading partners as bilateral trades can be transacted without reference to a third-party currency," he said.

Paul Welitzkin contributed this story.

Contact the writer at chenweihua@chinadailyusa.com and chenjia@chinadaily.com.cn