New loans and deposits jumped in June at the nation's four biggest lenders, the Shanghai Securities Journal reported on Thursday, indicating improved liquidity in the second half of the year.

New loans totaling 290 billion yuan ($47 billion) were extended by Bank of China Ltd, China Construction Bank Corp, Industrial and Commercial Bank of China Ltd and Agricultural Bank of China Ltd, according to the newspaper.

According to data compiled by Reuters, new loans by the four lenders totaled 272.8 billion yuan in May and 354.1 billion yuan in March.

Deposits grew a combined 2.2 trillion yuan, with 1.13 trillion yuan just on Monday, according to the Shanghai Securities Journal. It is a common practice in China that lenders shore up deposits at the end of each month to meet regulatory requirements.

|

|

"Real economic activity has improved ... potential financing needs in society have grown," the report said.

The central bank's open market operations and selected reserve requirement ratio cuts also played a part in the growth, it said.

The central bank has eased monetary policy to support growth. The economy continued to lose steam in the second quarter after posting the slowest growth in 18 months during the first quarter.

The People's Bank of China suspended repurchase operations on June 26 for the first time since February to smooth interbank liquidity conditions before the end of the second quarter. The PBOC injected 12 billion yuan into the open market, which was the seventh consecutive weekly liquidity injection since early May.

Liquidity is expected to stay ample in the year's second half.

"There are multiple factors that suggest there will be a drop in financing costs in the real economy in the second half," Bank of Communications said in the report. "The finance sector's support to the real economy will be strengthened."

The bank added that full-year new loans will total 10 trillion yuan, compared with 8.89 trillion yuan in 2013.

As of May, new loans totaled 4.66 trillion yuan.

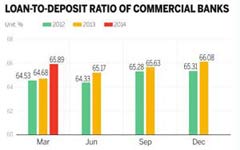

On Tuesday, the China Banking Regulatory Commission enabled banks to make more loans by changing the way lenders calculate loan-deposit ratios, a key banking liquidity indicator derived by dividing a bank's total loans by its total deposits.

"The adjustment makes the monetary policy condition more accommodative because more funds can be released from the banking sector," said Australia and New Zealand Banking Group Ltd in a report on Wednesday.

"We expect that the overall policy stance will become more supportive for growth in the second half of this year."