Rising yuan marks key milestone

By Xin Zhiming (China Daily)Updated: 2007-05-09 10:01

The central parity rate of the renminbi broke the 7.70

barrier against the US dollar yesterday as the US Congress today starts a

hearing on China's alleged exchange rate manipulation.

The central parity rate of the renminbi broke the 7.70

barrier against the US dollar yesterday as the US Congress today starts a

hearing on China's alleged exchange rate manipulation.

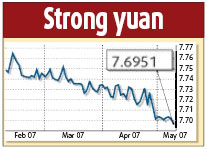

The mid-point rate stood at 7.6951 yuan to one greenback yesterday, the first trading day after the week-long May Day holiday, according to the Chinese Foreign Exchange Trading System.

It was a gain of 104 basis points from the reference rate of 7.7055 on the last trading day before the holiday and the highest since it was de-pegged from the US dollar in July 2005.

The yuan hit a new high for the 27th time this year.

Although it breached the psychological barrier of 7.70, it only shows that the currency is strengthening vis a vis the US dollar and does not have any special significance, said Yan Qifa, an economist with the Export-Import Bank of China.

The yuan's revaluation has been faster recently, gaining 287 basis points in April but "the process has remained largely stable in recent months", Yan told China Daily.

Zhao Xijun, finance professor at Renmin University of China, said the new rate indicates "the yuan is becoming more flexible" after its revaluation in 2005.

"The process has gone to a stage where the market forces play an important role in determining the rate," he said.

Market traders attributed the stronger mid-point rate to the expected pressure ahead of the US congressional hearing on foreign exchange "manipulation" by China and Japan.

While acknowledging the event would have some short-term effect on the upward movement of the renminbi, Zhao said the process has its intrinsic causes.

"The impact (from the US hearing) is insignificant," he said.

China's strong economy which grew by 11.1 percent in the first quarter its trade surplus and swelling foreign exchange reserves as well as speculative capital inflows are behind the rise of the yuan, he explained. "We want to, for example, resort to exchange rate adjustment to reduce the trade surplus."

Washington has consistently demanded that Beijing speed up the revaluation process and threatened punitive measures if China refused.

"Such measures will jeopardize the interests of both," Yan said.

Zhao said the demands from China's trade partners to revalue the renminbi are often because of their domestic political and industrial interests.

China has set the direction of the yuan revaluation, but must move in line with its own situation, Zhao said.

The yuan has appreciated 5.4 percent since July 2005 and many economists expect it to rise 4 percent against the US dollar this year.

(For more biz stories, please visit Industry Updates)

| ||