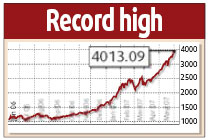

Shanghai index passes 4000 barrier

By Jin Jing (China Daily)Updated: 2007-05-10 09:01

For years, the Chinese stock market was an anomaly: its

performance inversely proportionate to the booming economy. It just wouldn't

budge.

For years, the Chinese stock market was an anomaly: its

performance inversely proportionate to the booming economy. It just wouldn't

budge.

In the past one-and-half years, after it shrugged off its stupor, it just won't stop.

On May 9, after another day of hectic activity, the Shanghai Composite Index broke through the psychological barrier of 4000 points to close at another record high of 4013.09.

The smaller Shenzhen Composite Index also surged in its wake, closing 0.3 percent higher at 1111.29, also a record.

The buying momentum picked up in the afternoon after a volatile morning session. There was heavy selling when the index crept past 4000 at around 11 am. Before the noon break, the index was down 0.9 percent at 3926.45.

The bulls returned in force after the lunch break and pushed the index up a whopping 63 points, or 1.6 percent, with 369 out of 907 stocks closing higher. Turnover on the Shanghai bourse ballooned to 255.3 billion yuan ($33.2 billion), breaking the record of 205.2 billion yuan ($26.6 billion), set the day before.

The foreign-currency denominated B-share index rose 17.39 points, or 6.88 percent, to close at 270 yesterday, after it soared 9.3 percent the day before.

Share prices have already risen 50 percent in Shanghai this year, following a 130 percent gain last year. And the Shenzhen Composite Index is up 100 percent this year.

Analysts predicted that the market, underpinned by a continuous inflow of funds, restructuring of State-owned shares, a softening property market and strong company fundamentals, will rise to new highs in the near future. The resistance level has now been raised to 5000.

"It is likely that the index will continue upward to 5000 within one or two months if we do not see some action from Beijing to cool things down," Stephen Green, senior economist from Standard Chartered Bank, said yesterday.

Chen Wenzhao, an analyst at Changjiang Securities, said: "China's large trade surplus, which has led to enormous liquidity, will continue to push the stock market in the first half of this year."

Stocks in the financial sector led yesterday's trading. Citic Bank, which made its debut on April 27, soared to its daily allowable limit to close at 11.46 yuan.

Real estate companies continued their strong performance. Vanke A soared 10 percent to close at 21.88 yuan, while Shenzhen Zhenye Group jumped 9.99 percent to close at 22.25 yuan. Companies in the pharmaceutical sector also did well.

But Stephen said the government may take some sort of action, including imposing a capital gains tax, raising interest rate rises, talking the market down or encouraging one or two large-capitalization firms to sell their State shares to increase equity flows.

"Policy action is more likely as the index moves up toward 5000,?he said.

He and other analysts who warn about government action apparently took their cue from Zhou Xiaochuan, governor of the central bank, who reportedly said in Switzerland on Sunday that he "was worried?about a bubble in the stock market.

(For more biz stories, please visit Industry Updates)

| ||