Reserve ratio hike fails to slow indices

Updated: 2007-08-01 08:32

Major Chinese stocks absorbed the impact of the overnight reserve ratio hike decision with a slight correction in the morning and obtained another new high on Tuesday. However, although the market has performed strongly recently, securities insiders warn it's wise to keep negative factors in mind.

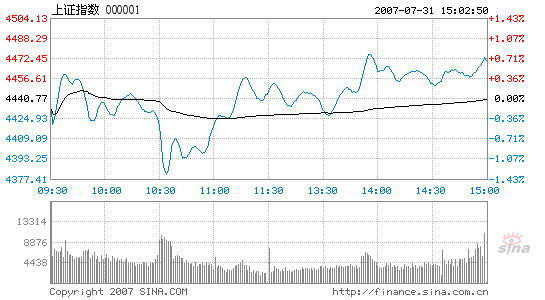

Affected by the central bank's decision, the benchmark Shanghai Composite Index opened at 4432.27 points, eight points lower than Monday's close. After diving to the day's lowest of 4379 points around 10:30, the index rebounded quickly to the red and another new high of 4476 points in the afternoon session. It ended the month's trading with an unprecedented close of 4471.03 points, up 0.68 percent and challenging the higher 4500-point level. Total turnover of the market was 152.1 billion yuan, slightly lower than that of the previous trading day.

The Shenzhen Component Index, which covers the smaller mainland stock market, inched up 0.92 percent and closed at 15199.56 points. The market saw 84.6 billion yuan of stocks traded on the day.

Shanghai Composite Index

Stock performance was mixed, with 795 stocks up, 530 down and 134 flat. Almost 50 stocks reached the upward limit. Sectors of nonferrous metals, cement, and wine making were among the top gainers.

The central bank announced yesterday a rise in the reserve ratio by 0.5 percentage point to 12 percent beginning August 15. It marks the sixth increase this year, widely considered as further attempts at mopping up excess liquidity by tightening bank credit.

Yet even share prices of listed banks were not greatly affected due to the robust half-year earnings. Bank of China slightly fell 0.55 percent to 5.43 yuan; while China merchants Bank gained 1.43 percent although opened lower in the morning.

However, there are reasons to exercise caution. The China Securities Journal reported today that more than 6.95 billion shares from 100 listed companies with a market value of 126.6 billion yuan are allowed to be traded publicly from August according to their share-holding reform schedule. Some dealers worried that the additional shares in circulation may take funds from the market and undermine the upward momentum of the index in the short term.

The whole month of July saw the index surge more than 900 points from its lowest 3563 to a high of 4471, a historical high. For most investors, the past month was a dramatic shift from pessimism to high hopes as well as a challenge to their patience and endurance.

Insiders were reminded that a sober investment is necessary when the market reaches record highs. According to them, analysis based on all kinds of information including the bad news, is more helpful than rumors or hearsay.

|

|