Volatility looms large after Shanghai index hits new high

Updated: 2007-08-15 18:07

Stock investors in China took a roller coaster ride on Wednesday as the Shanghai index fluttered violently in response to neighboring markets after a new record-high.

Opening at 4875.51, the benchmark Shanghai Composite Index broke the 4,900 point barrier in the morning session and briefly hit 4916.31 points around ten o'clock. After that high, the index made a steep dive of 150 points to below 4,700 points within the next two hours, mimicking a simultaneous plunge of the Hang Seng Index.

However, dramatic changes occurred again at the beginning of the second session when the index jumped back from the day’s lowest of 4762.72 points to a maximum 30 points gain. It ended the day’s dramatic trading at 4870.25 points with a minute correction of 2.54 points or 0.05 percent. Transaction value of the market climbed to 133 billion yuan, slightly higher than yesterday’s figure.

| Shanghai Composite Index Source: www.sina.com.cn |

|

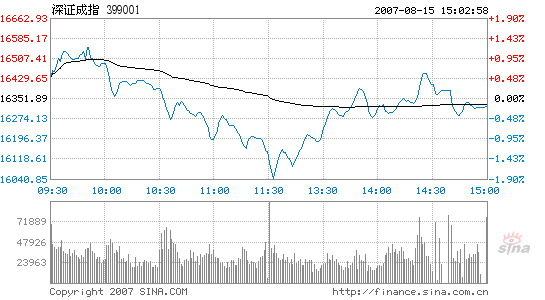

The Shenzhen Composite Index, which covers the smaller Shenzhen stock market, also recovered from a maximum 1.9 percent loss and closed at 16322.52 points with a turnover of 67.4 billion yuan.

Of all the stocks traded today, 454 gained, 136 closed flat, and 880 went down. Two major beneficiaries of the appreciating renminbi - the real estate and banking sector ignored the fluctuating index and staged solid performances today.

| Shenzhen Component Index Source: www.sina.com.cn |

|

Huaxia Bank led the banking sector with a 9.04 percent gain and a historic high. Minsheng Bank Corporation and Industrial Bank also followed suit with notable gains over three percent. Shares of Tianhong Baoye, a promising real estate company in Beijing, clinched the limit up of 46.07 yuan per share.

The China Securities Regulatory Commission yesterday released a new rule allowing companies listed on the Shanghai, Shenzhen, or overseas markets to issue corporate bonds on a trial basis. The measures are designed to help expand enterprises' financing channels, enrich securities investment tools, and boost harmonious development of the equity market in the long run.

In the near future, other popular themes like the surging half-year corporate profits, anticipation of renminbi appreciation, and the incoming index future could further propel the bullish market, according to some market watchers.

|

|