Stocks fall on CCB debut, Shenhua issuance

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-09-25 16:31

Updated: 2007-09-25 16:31

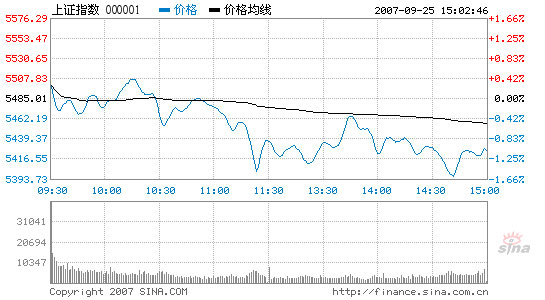

Shanghai Composite Index [sina.com.cn] |

Chinese stocks were weak today under tremendous capital dilution pressure from the introduction of China Construction Bank (CCB) shares and the start of online subscriptions by China Shenhua Energy Co Ltd. The new bank reserve ratio, 0.5 percentage points higher than the previous one, also took effect today, constituting to depressing forces in the market.

The Shanghai Composite Index closed at 5,425.88, down 59.13 points or 1.08 percent. The Shenzhen Component Index finished at 18,346.45, down 72.03 points or 0.39 percent. Total turnover of stocks in the major indices shrank to 205 billion yuan, the lowest this month.

Weak performance of heavyweight bank shares dragged the indices down. Except CCB and Bank of Ningbo, all banks were down. The Industrial and Commercial Bank of China (ICBC), China Minsheng Banking Corp and Bank of China (BOC), top among the largest traders, fell 2.99, 2.63 and 1.68 percent respectively.

On the other side, CCB shares closed at 8.53 yuan, up 2.08 yuan or 32.25 percent from their initial public offering (IPO) price of 6.45 yuan, after opening higher from 8.55 yuan this morning. As today's largest trader in terms of transaction value, CCB turnover reached 2.7 billion shares worth 23.8 billion yuan.

The closing price of CCB shares represents a price to earnings ratio of 56.9, as the bank has earnings per share of 0.15 yuan in the first half, higher than the 0.12 yuan of ICBC and BOC. CCB reported its first-half net profit rose 47.5 percent to 34.2 billion yuan from a year earlier.

Shares in Beijing-based CCB, China's second largest bank by assets, began trading today on the Shanghai Stock Exchange after its IPO raised 58 billion yuan, a record for a domestic bourse.

The bank, which already has shares traded in Hong Kong, issued 9 billion shares in its IPO and drew a record 2.26 trillion yuan in subscriptions, almost 40 times the amount it was trying to raise. Of the 9 billion shares, 2.3 billion were acquired through offline subscriptions and held by institutional investors under a three-month lock-up restriction.

The IPO far exceeded the 46.6 billion yuan raised in the Shanghai portion of a dual share offering by ICBC in October 2006 - the previous record for a domestic share offering.

Its Hong Kong-listed shares, however, were down 5.28 percent to HK$7.1. CCB, originally set up to fund property and infrastructure projects, was the first of China's Big Four State banks to stage an IPO in Hong Kong, in October 2005.

|

|