|

BIZCHINA> Top Biz News

|

|

Analysts bullish about H shares

By Joey Kwok (China Daily)

Updated: 2009-02-20 08:01

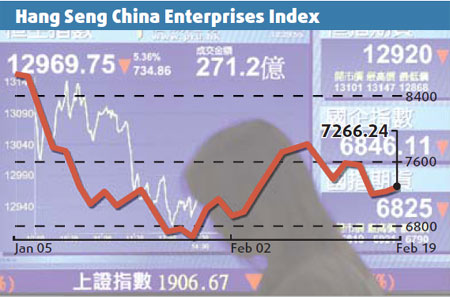

Despite the latest sharp correction in the mainland stock market, analysts have expressed confidence on the long-term prospects of H shares of mainland enterprises listed on the Hong Kong bourse. The analysts expect shares of Hong Kong-listed mainland companies to rebound by the end of the year and benefit from the central government's economic stimulus package.

"The economy and stock market on the mainland will outperform overseas markets," said Lai. He expects the good performance of the A shares to help increase H-share prices too. Lai, however, said H shares may retreat after they touch a peak, as they are relatively more sensitive to external market conditions than A shares. "The future performance of the shares will largely depend on the global economic recovery and on whether a second financial crisis emerges in the US," Lai said. JP Morgan's Asian Fund had earlier said it expects H shares to rebound to 25 percent this year, following the stimulus moves. H shares will advance further if the government unveils more measures on top of the 4 trillion-yuan stimulus package announced in November last year, said Howard Wang, managing director of JP Morgan Asset Management's Pacific regional group. Wang said the economic growth in China would decline to 5 to 6 percent this year, prompting the government to implement more measures to lift domestic consumption to counteract the weakening exports. H shares, therefore, could catch up with the 25 percent jump in A shares and B shares so far this year, he said. Karl Thomson Securities Chief Portfolio Strategist Patrick Shum said the positive effect of the economic stimulus measures on H shares will be relatively less significant than that on the A shares, since foreign investors also participate in the H-share market. "H shares may not directly follow the surge in A shares. However, it may drop less than the benchmark Hang Seng Index," Shum said. Both Lai and Shum expect the Hang Seng China Enterprises Index, which measures the H shares of mainland companies, to peak at 8500 points this year. However, Shum said the shares may tumble and test the 6000 levels. "The effectiveness of economic stimulus measures by governments across the world and the recovery of the US economy will be the key," Shum added. BNP Paribas Investment Partners has urged investors to pick up H shares as the bank expects the stimulus package to boost corporate earnings. BNP has an "overweight" rating on H shares and said it favors real estate and financial industries. Linus Yip, strategist, First Shanghai Securities, said the positive impact of the stimulus package has already been felt on the shares and the future performance hinges on the economic growth in the mainland. Yip said shares in infrastructure, electricity and commodities would benefit more from the government policies. "However, as the entire economy on the mainland is encountering a slowdown, these sectors too can hardly avoid the impact," Yip said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 灌南县| 武川县| 呼伦贝尔市| 延吉市| 义马市| 常宁市| 泰来县| 涿州市| 苗栗县| 富裕县| 新乡市| 垫江县| 马关县| 桂阳县| 永寿县| 玛纳斯县| 蓬溪县| 三明市| 政和县| 博湖县| 南安市| 永顺县| 海南省| 行唐县| 黑山县| 肇源县| 色达县| 五常市| 洱源县| 溧阳市| 合作市| 新郑市| 德格县| 米林县| 南通市| 兴安县| 长兴县| 新昌县| 扶余县| 鄂托克旗| 杭锦旗| 玉屏| 镇雄县| 齐齐哈尔市| 淳安县| 宜君县| 桓仁| 勃利县| 梓潼县| 延川县| 乐陵市| 曲麻莱县| 阿克| 黄梅县| 云梦县| 手游| 乌拉特后旗| 凭祥市| 余干县| 凤台县| 和田县| 开封县| 武鸣县| 获嘉县| 务川| 漳浦县| 都江堰市| 乐业县| 民丰县| 绥芬河市| 阳高县| 宕昌县| 焦作市| 大同县| 昌图县| 庄浪县| 大连市| 洱源县| 宁乡县| 银川市| 深圳市| 乐清市|