|

BIZCHINA> Top Biz News

|

|

Stocks plunge on lending concerns

(China Daily/Agencies)

Updated: 2009-08-20 08:05

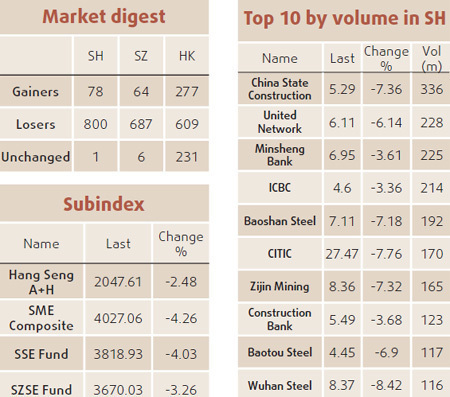

China's stocks fell, briefly driving the benchmark index into a so-called bear market, on concern tighter lending will damp economic growth. The Shanghai Composite Index lost 4.3 percent to 2,785.58, as China Shenhua Energy Co, the nation's largest coal producer, sank 6.8 percent, the most since Feb 18, and CITIC Securities Co, the biggest brokerage, sank 7.8 percent. The gauge has slumped 19.8 percent since this year's high on Aug 4, after more than doubling from November's low as China rolled out a 4-trillion-yuan stimulus package. A plunge in new bank loans in July, disappointing earnings and concern the government will seek to damp property market speculation have sapped confidence. "It's irrational selling that has shattered market confidence," said Larry Wan, Shanghai-based deputy chief investment officer at KBC-Goldstate Fund Management Co, which oversees about $583 million in assets. "Some mutual funds have been reducing their stock holdings as they are pessimistic about the economic outlook." China Everbright Securities Co, which had the smallest first-day gain of any new stock in Shanghai this year, slumped by the 10-percent daily limit yesterday. "The Chinese market is very trend-oriented because there are many individual investors," said Philippe Zhang, chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $220 million. "It can rally very quickly and go down strongly as well."

"The current correction is reflecting the tightening in lending," said Andy Xie, a former Asian chief economist at Morgan Stanley, who correctly predicted in April 2007 that China's equities would tumble. "We've seen the peak of this market cycle, though there's likely to be a bounce as the government seeks to stabilize the market." The market may extend its decline by another 10 percent, Xie said on Aug 17. Even with the recent decline, the Shanghai index is trading at 30.4 times reported earnings, against 17.5 times for shares on the MSCI Emerging Markets Index. An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months, China Business News reported on June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 稻城县| 堆龙德庆县| 临夏市| 东乌| 城口县| 西吉县| 鹤岗市| 碌曲县| 郯城县| 应用必备| 从江县| 晋中市| 黄石市| 阳西县| 班玛县| 锦屏县| 宿松县| 清河县| 左贡县| 贵港市| 兴城市| 黎川县| 黄山市| 五指山市| 峨边| 霞浦县| 上虞市| 祁阳县| 剑河县| 永州市| 石门县| 兴安县| 信丰县| 许昌市| 锦州市| 延边| 紫云| 高淳县| 望谟县| 石狮市| 南丹县| 临城县| 凤阳县| 嘉兴市| 临清市| 进贤县| 原平市| 南开区| 吉木乃县| 库尔勒市| 龙里县| 惠州市| 朔州市| 佛教| 郁南县| 哈尔滨市| 嫩江县| 石嘴山市| 揭阳市| 西畴县| 昌平区| 原阳县| 郁南县| 灵山县| 南召县| 弋阳县| 高阳县| 库伦旗| 内黄县| 铜陵市| 多伦县| 达尔| 柞水县| 延川县| 南漳县| 呼图壁县| 建湖县| 南投县| 唐海县| 深圳市| 临沭县| 利辛县|