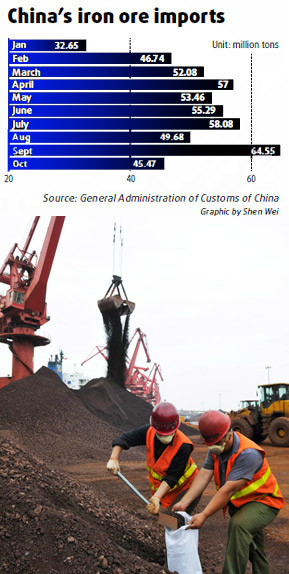

InfoGraphic

Baosteel set to lead iron ore parleys

By Zhang Qi (China Daily)

Updated: 2009-12-09 07:57

Action seems to be hotting up on the iron ore price negotiation front with steelmaker Baosteel Group replacing China Iron and Steel Association (CISA) as the chief negotiator for the Chinese side in its talks with the big three iron ore suppliers, BHP Billiton, Rio Tinto and Vale.

The negotiations, which are likely to start by the end of December, also assume significance against the backdrop of Rio and BHP further consolidating their mining operations over the weekend.

This year's iron ore price negotiations reached an impasse in June after China's chief negotiator CISA insisted on a 45 percent discount over last year's prices, after a 33 percent cut in benchmark iron ore prices had been reached by the "Big Three" with other Asian steel mills.

|

|

Chinese steel mills have since then started sourcing ore supplies from the spot market or signed individual contracts with the "Big Three", for a 33 to 28 percent cut, without revealing details.

Baosteel, the country's largest steel mill, was always at the forefront of the iron ore pricing talks since 2003, but was replaced by CISA this year as prices continued to increase.

The bitter and protracted row over the ore talks raised doubts in industry circles on whether the association was the right candidate to spearhead the negotiations.

"Next year's iron ore talks could see results, as Baosteel has several years of experience in iron ore talks. They are also capable of formulating decisions that can best encompass the prevailing market trends," said Yu Liangui, a steel analyst with Mysteel Research Institute.

During the 2007 negotiations Baosteel achieved the first price agreement of that year with Vale of Brazil, only 9.5 percent up from the previous year. Achieving the first agreement of the year was crucial, as it prevented the levels of other international agreements pushing the price up for China. This meant that in 2007, China's steelmakers achieved record profits on the back of stable and relatively low production costs.

"It would suit Baosteel better if it is able to reach a first price agreement with Vale as it is a long-term price advocator. Such a move would also be a blow to BHP, which always prefers to use the spot price to follow the long-term price," said Yu.

However, he warned that inordinate delays in fixing a price would be detrimental for Chinese steelmakers as prices may go up once the global economy starts recovering.

Baosteel is planning to replace its present chief negotiator Ding Shouhu in next year's talks, while Rio Tinto may also have a new representative, according to sina.com.

The real challenge in next year's talks would be to achieve a price that is in the best interests of all concerned. That seems to be a tough task as international analysts have predicted a 20 to 30 percent increase in iron ore prices for 2010.

The decision of Rio Tinto and BHP Billiton to merge their Australian iron ore resources is also not good news for Chinese steelmakers.

The two mining giants signed a binding agreement last week to consolidate their iron ore operations in Western Australia. Plans for the joint venture were originally announced in June and are awaiting regulatory approval.

|

||||

Zhang said Chinese steel mills should look at diversifying their iron ore supplies further and also improve the negotiation tactics at the talks.

Yang Siming, chairman of Nanjing Iron & Steel Group, said benchmark iron ore prices might rise 5 to 10 percent next year. But the bigger worry for Chinese mills would be the skyrocketing ocean freight charges.

Analysts also feel that the joint moves by BHP and Rio would propel Chinese steelmakers to the industry consolidation mode.

The Chinese government has for long wanted to consolidate the fragmented industry as domestic steel firms are disadvantaged in annual international iron ore negotiations due to the low industry concentration.

The nation's iron ore imports rose 36.8 percent to 45.5 million tons in the first 10 months from a year earlier, Customs said on Nov 12.