Property prices cooling in more areas

Updated: 2011-07-19 08:57

By Hu Yuanyuan (China Daily)

|

|||||||||||

Biggest rises registered in smaller cities as curbs expected to expand

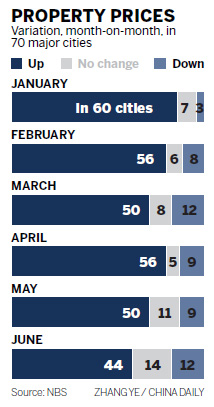

BEIJING - More cities experienced cooling property prices in June, compared to May, as policies targeting speculation kicked in.

Property prices fell in 12 of the 70 major cities monitored, and remained unchanged in 14, when measured against May's figures, the National Bureau of Statistics (NBS) said on Monday.

In May, there were 20 cities where property prices either fell or remained unchanged when measured against the previous month.

But Prices in Beijing, Shanghai and Guangzhou - the bellwethers of the property market - all showed solid year-on-year gains in June, according to the NBS.

The scale of the June increase was slightly higher than in May.

Only three cities experienced a year-on-year price drop in June.

Larger year-on-year gains were mostly seen in smaller, and less developed cities.

Urumqi, capital of the Xinjiang Uygur autonomous region, posted the biggest gain at 9.2 percent in June. Prices in Lanzhou, capital of Gansu province, rose 8.2 percent year-on-year.

"The data explain why the government plans to extend real estate curbs from key cities to second- and third-tier cities," Qin Xiaomei, chief researcher at international real estate service provider, Jones Lang LaSalle, said.

The State Council, or the Cabinet, said last week it will expand restrictions on home purchases from major cities to smaller ones to tackle escalating property prices. The government is drawing up a list of the smaller cities, China Business News reported on Monday, citing an unidentified source close to the Ministry of Housing and Urban-Rural Development.

The planned expansion of tightening measures is a "wake-up call" for developers hoping that policies may relax in the second half of this year, Credit Suisse Group AG said in a recent research note.

According to Frank Liu, vice-president of E-Commercial (Shanghai) Real Estate Advisory Co Ltd, some developers have experienced diminishing cash flow.

On June 15, Standard & Poor's cut the outlook for developers to "negative" from "stable", adding tighter credit and further government curbs may lead to rating downgrades in the coming year.

Developers have large inventories allowing more flexibility in prices, Liu said.

Stephen Green, an economist with Standard Chartered Bank, said in a recent survey that property inventories in 35 major cities currently stand at about three months worth of supply, levels not seen since the worst of the market slump in 2008-2009.

With the supply of low-cost welfare housing picking up and continued tighter regulations over the commercial residential sector, most experts said property prices would drop in the coming months.

"Property transactions will remain sluggish in the second half, with property prices falling in some cities, though a dramatic decrease is unlikely," said Danny Ma, senior director of CBRE Research China.

Lin Lei, marketing chief of Century 21st Century, a US-listed property service provider, said inventories will increase as home purchase restrictions continue in key cities and expand to smaller ones.

"We forecast a sluggish market in the coming months and property developers will have to take more bold moves in cutting prices," Lin said

Meanwhile, the ballooning debt of local governments, whose fiscal revenue is largely dependent on land sales, will probably help cool property prices in the second half of the year.

According to the National Audit Office (NAO), local governments had an overall debt of 10.7 trillion yuan ($1.65 trillion) by the end of 2010, more than one-quarter of the country's GDP.

"Local governments will have to put more land parcels on the market, but at more reasonable prices," Liu said.

Residential land prices across 130 cities have eased 13 percent year-on-year in the first half of 2011, according to data from the China Real Estate Index System.

As policies in the residential sector remain rigorous, more investors and developers will turn their attention to other commercial sectors.

Vacancies in Beijing's Grade A office market fell to a 20-year low and rents were close to record highs in the second quarter, thanks to strong demand, according to industry statistics.

Foreign institutional investors are targeting offices in first-tier cities and commercial properties in second-tier cities. Property developers are striving to diversify to hedge risks, with more capital running into the commercial property sector and tourism real estate.