This year has witnessed a sharp rise in M&A activities in China's technology sector.

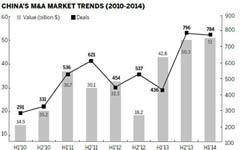

Data from Dealogic, a global market observer, show that acquisitions led by Chinese technology firms reached $25.6 billion by last Tuesday, compared with $9.3 billion during the same period last year, and $17.66 billion for 2013. Year-to-date deal volume reached a record high of 275 deals, compared with 218 for 2013.

While overall Chinese acquisitions have reached a record $162.5 billion so far this year, up 27 percent year-on-year, the technology sector saw 175.72 percent growth in value, making it the third most active sector in M&A activities after resource and finance. The deal value of outbound technology M&A surged 175.77 percent year-to-date.

|

|

|

"Competition is intense across all segments in the technology market, particularly among the online players. They are under a lot of pressure to have the latest technologies," she said.

Acquisitions make sure big companies "stay ahead of the curve", she said.

Increasingly, Chinese enterprises are looking outside the country for more choices.

"Over the past several years, Chinese companies have grown significantly from a market cap perspective, some cases larger than their US comparable. As domestic market opportunities mature and competition heats up, companies are looking outbound for technology, products and channel access to new markets. Some also go abroad following their clients' footprints. They need to have presence where their clients are," said Winston Cheng, head of Asia TMT investment banking at Bank of America Merrill Lynch, who advised IBM on the sale of its server business to Lenovo.

He said that US players used to feel they were the best bids for global assets. "But now they are starting to worry that the Chinese are becoming equally strong. Today people are increasingly looking at taking Chinese money and gain a strategic partner with a unique business model or access to the China market."

Regulatory change is certainly in favor of the supply-demand dynamic. A set of new rules issued by the National Development and Reform Commission, including the Administrative Measures on Approval and Filing of Outbound Investment Projects, took effect this May.