China Unicom shakeup a milestone in SOE reform

|

|

The display area of China Unicom at an industry expo in Beijing. WANG XINFENG / FOR CHINA DAILY |

Experts sees it as breakthrough for involving internet firms, employee incentive shares, mixed-ownership

The $11.7 billion share sale by China United Network Communications Group Co Ltd, the country's second-largest mobile carrier by subscribers, marks a milestone in the Chinese government's push to further rejuvenate State behemoths with private capital, signaling that a number of investment opportunities will emerge from mixed-ownership reform, experts said.

As it is the first in a batch of State-owned enterprises slated for mixed-ownership reforms, the plan disclosed by China Unicom is a great breakthrough, as it involves internet companies, employee incentive shares and enterprise governance, said Li Jin, chief researcher at the China Enterprise Research Institute.

"China Unicom has made a big step in its reform and laid a foundation for the subsequent reforms of other State-owned enterprises," Li said.

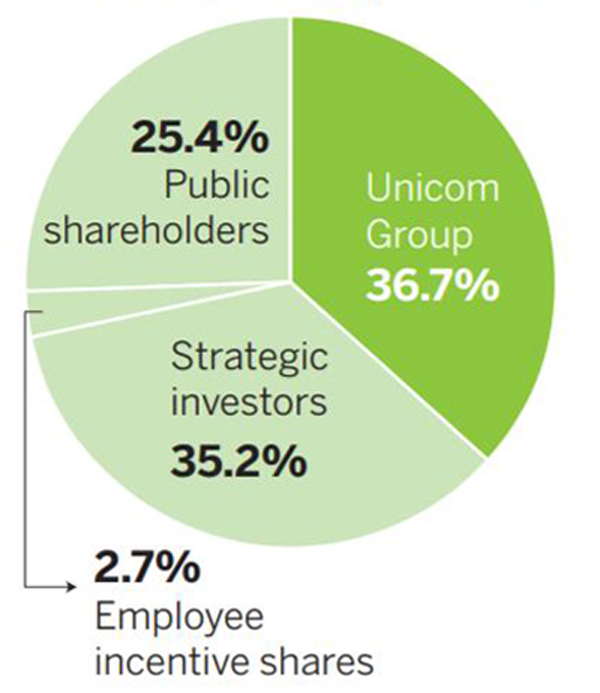

According to the plan, more than a dozen strategic investors, including tech heavyweights Tencent Holdings Ltd, Alibaba Group Holding Ltd, Baidu Inc and JD.com Inc, will buy a 35.2 percent stake in China Unicom's Shanghai-listed arm, in a deal that will raise around 78 billion yuan ($11.7 billion).

The unlisted, State-run parent will see its stake shrink to 36.7 percent from 62.7 percent, but remain the biggest owner. State-owned enterprises including China Life Insurance Co and China Structural Reform Fund Corp also participated in the share sale.

|

|

Unicom A share company shareholding structure after mixed-ownership reform LIU LUNAN / CHINA DAILY |

Li said: "It is a breakthrough for China Unicom to take employee incentive shares into consideration, which is a good reference as the following batch of companies could consider granting shares to their employees in their reforms."

"The plan sets a good example for other State-owned enterprises and promotes mixed-ownership reform. It is also beneficial to break the monopoly in the telecom sector and encourage other telecom carriers to carry out reforms," said Shi Wei, a researcher at the Institute of Economic System and Management under the National Development and Reform Commission.

According to China Unicom, bringing in new investors will help the company improve its innovative capacity and allow it to transform from a traditional mobile carrier to an integrated information and technology operator.

"This ownership reform is a strategic move for all parties involved. The technical assets and experience of internet companies are crucial for China Unicom to improve its service quality and operational capabilities," said Charlie Dai, principal analyst at Forrester Research Inc.

"China Unicom's rich infrastructure resources and partner ecosystem will also help these new investors speed up their business expansion and penetration in different areas, including cloud computing, artificial intelligence and the internet of things, Dai added.

However, dealing with diversified shareholders is a complicated problem and raised concerns that State-owned assets may face losses, analysts said.

Moreover, two filings published on the website of the Shanghai Stock Exchange were no longer available at 8:30 pm on Wednesday. China Unicom was not immediately available for comment.

In terms of the reasons behind the withdrawal of the filings, a report by financial news website caixin.com, citing industry analysts, noted details regarding the pricing of the new shares and investors' shareholdings may have contradicted the new rules that Chinese security regulators issued in February.

Cheng Yu contributed to this story.