|

CHINA> National

|

|

China's US treasury debt holdings up

By Xin Zhiming (China Daily)

Updated: 2009-02-19 07:53

China's treasury debt holdings in the US grew by $14.3 billion in December amidst speculation that it was seeking other options to deploy its nearly $1.95 trillion in foreign exchange reserves.

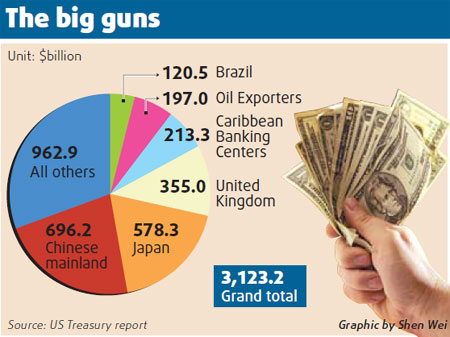

The nation's holdings of the treasuries totaled $696.2 billion in December, up from $681.9 billion in November 2008, the US Treasury international capital flow report released yesterday showed.

China has accelerated its holdings of treasury debt since August 2008, when holdings grew by $23.7 billion month-on-month. By September, it had replaced Japan as the primary holder of these debt instruments. Analysts said since the treasuries are relatively stable in value compared to other financial products, China has apparently aimed to play safe by buying up these US bonds. However, now that China's holdings of treasuries account for one-third of its foreign exchange reserves, some warned that "putting all eggs in one basket" is risky. "China needs to diversify its foreign exchange reserves basket," said Zhang Ming, economist with the Institute of Finance and Banking at the Chinese Academy of Social Sciences. "Its holdings of these treasuries face the danger of a price drop as the US is expected to issue more bonds to stimulate its economy," he told China Daily. With US interest rates at near-zero levels, the dollar's value may slide, and its recent strong rally may not sustain, economists said. The sliding dollar will push down treasury debt prices, economists said. "As these treasuries are much sought after by international investors, it is time China took advantage of the timing to cut its holdings," Zhang said. China should use its abundant foreign exchange reserves to buy commodities and energy products to support its economic growth, said Guan Qingyou, a researcher with Tsinghua University. Premier Wen Jiabao has said that the country is studying ways to use its foreign exchange reserves to buy equipment and technologies that are key to its economic development. Despite uncertainties about the prices of US treasuries, international investors remain invested in the US market. The report has shown that net capital inflows into the US rose to $74 billion in December from $61.3 billion in the previous month. Foreign holdings of dollar-denominated short-term US securities, including treasury bills, increased $2.1 billion in December. Net foreign purchases of long-term securities reached $22.4 billion in December compared with a net selling of securities worth $37.6 billion in November, according to the report. |

|||||

主站蜘蛛池模板: 广平县| 昌平区| 克东县| 桦南县| 襄城县| 革吉县| 砚山县| 金堂县| 绵阳市| 江永县| 永清县| 儋州市| 长白| 莒南县| 北海市| 郑州市| 富源县| 黔江区| 湖州市| 思茅市| 东方市| 山西省| 东乡县| 大足县| 庆城县| 乌拉特前旗| 潮州市| 阿勒泰市| 定陶县| 新邵县| 陆河县| 色达县| 广水市| 双江| 剑河县| 砀山县| 吴江市| 轮台县| 都昌县| 仁怀市| 军事| 分宜县| 苍溪县| 静安区| 沾化县| 琼海市| 仁寿县| 海阳市| 宜宾市| 富顺县| 潜江市| 阳曲县| 亚东县| 淮滨县| 盱眙县| 绵竹市| 横峰县| 哈巴河县| 济源市| 信阳市| 满洲里市| 南江县| 双柏县| 左贡县| 福州市| 邳州市| 高清| 黄石市| 永泰县| 石景山区| 西充县| 开鲁县| 遂川县| 永平县| 湟中县| 广平县| 宁陕县| 方山县| 达孜县| 弥渡县| 武穴市| 三台县|