Economy

Economists warn of housing bubbles

By Wang Xiaotian and Xin Zhiming (China Daily)

Updated: 2010-01-26 06:55

|

Large Medium Small |

World Bank economists yesterday warned about the risks of asset bubbles in China even as the government tries to hold back excessive lending and keep prices stable.

Asset price inflation, or increases in housing prices in particular, is potentially "very dangerous" for China because they are self-reinforcing, made possible by "very cheap credit", said Hans Timmer, director of the development prospects group at World Bank.

| ||||

"If the price in a grocery store goes up, then demand comes downs; but if the housing price goes up, then actually demand might increase because people expect further increases," he said. "This is a much more dangerous phenomenon."

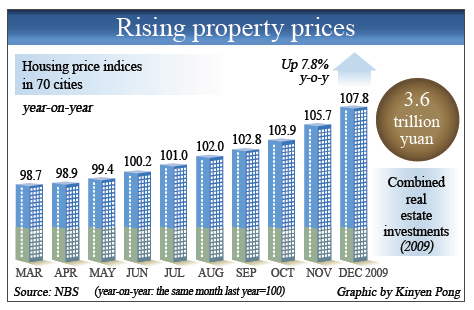

Housing prices in 70 major Chinese cities increased by 7.8 percent year-on-year in December, the fastest pace in 2009, according to official data. But many people complain that price rises are much higher than indicated in the index and have become unaffordable.

Economists, meanwhile, are worried about "house price bubbles" bursting, which could affect the balance sheets of banks and the health of the overall economy.

"I can't say there are (asset) bubbles at the moment," Timmer said. "But there's a risk it is an area where you have to keep your eyes peeled."

Dong Yuping, senior economist at the Chinese Academy of Social Sciences, said: "Although house prices rose very fast in some big cities last year, it is hard to say if bubbles have already formed. There are few widely-agreed standards for us to decide whether there are bubbles or not."

He said, however, that policymakers must be cautious. "If house prices continue to rise faster than people's income growth, the risk of bubbles would be higher."

Timmer said the Chinese government has taken appropriate measures to keep the risk under control. "The first step is to recognize this is a potential issue and be willing to act, and the Chinese government does both."

The government has raised taxes on sales of second-hand homes and tightened land transfer rules, among others, to hold back surging prices.

"The government is concerned about property prices rising too rapidly and sensitive to middle-class discontent about housing affordability," said Wang Tao, head of China economic research at UBS Securities.

"However, in an overall environment of weak global demand, the government will be cautious very careful to avoid dampening overall activity in the sector."

The government is expected to tighten monetary policy to reduce the scale of lending and prevent liquidity-fueled inflation. Last year, new yuan lending increased to 9.6 trillion yuan ($1.4 trillion), almost double that of the previous year.

Timmer said China is yet to see a real threat of high inflation, although the consumer price index (CPI), a key gauge of inflation, rose sharply by 1.9 percent in December, compared with 0.7 percent a month earlier.

"I'm not that afraid that there'll be a fast inflation rise," he said.

Timmer said China's CPI growth since last November has had a lot to do with the surging international commodity prices that plunged at the end of 2008. "It's not necessarily a sign of ramping inflation," he said.

|

|

Some economists have warned that the CPI could rise to 5 percent or even higher this year, although most analysts believe that the government can keep it under 3 or 4 percent.

The World Bank also suggested China tackle some long-term issues, such as structural reforms, to make its economic growth more sustainable.

The most important task for Chinese economic policymakers this year is not setting the timing of an exit strategy, but lay the foundation for structural changes in its economy in the future, economists said.

The biggest challenge is to create permanent demand to replace the stimulus measures which are "by definition, temporary", said Ardo Hansson, lead economist with the World Bank China Office.

He said reforms in healthcare, pension, rural land transfer, and hukou (permanent residence) regimes that have been announced would help make domestic demand growth more sustainable.

According to the World Bank report on global economic prospects released on Jan 21, the world economy could expand by 2.7 percent year-on-year this year while China's GDP growth could reach 9 percent.