Economy

China urges US to reduce investment barriers

By Ding Qingfen (China Daily)

Updated: 2010-11-02 07:11

|

Large Medium Small |

China backs outbound investment, but questions why obstacles remain

BEIJING - China is encouraging investment into the United States, but is also urging the world's largest economy to improve its investment environment and reduce barriers.

China has so far invested "more than $900 million" in the US non-financial sector, and is encouraging and assisting more domestic enterprises to inject funds "in all areas", Chen Jian, vice-minister of commerce, told a news conference on Monday.

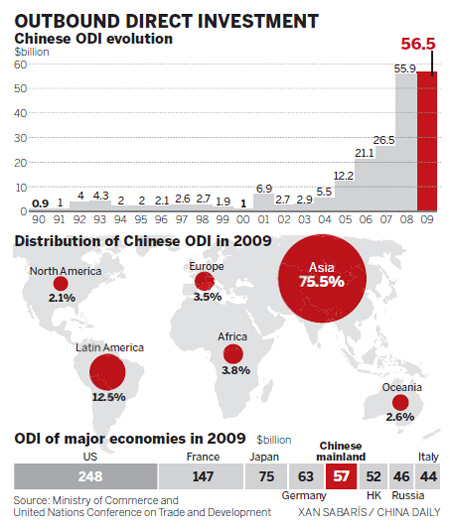

The amount is just a fraction of China's total overseas investment of $56.5 billion in 2009, despite the huge trade volume between the two largest global economies.

Chen said that in the next five years, China's outbound direct investment (ODI) will make huge strides, both in size and quality, and consequently its contribution to GDP growth will rise significantly and boost the nation's global influence as an investor.

While the Chinese government has been urged by the US and some European nations to allow its currency to rise, Chen said ongoing yuan revaluation will have a positive effect on Chinese overseas investment, although he believed currency appreciation will hurt exports.

The ministry on Monday launched its 2010 Report on Development of China's Outbound Investment and Economic Cooperation. In 2009, China's ODI reached $56.5 billion, catapulting the nation to fifth largest, by volume, from 12th position. From 2002 to 2009, China's ODI grew by 54.4 percent annually.

"China's overseas investment activities are still at a fledgling stage, despite the rapid growth," Chen said. Chinese companies' lack of experience in internationalization and management curtailed high-end investment, he added.

Song Hong, a researcher on international trade with the Chinese Academy of Social Sciences, said China's ODI is expected to grow more rapidly than direct foreign investment and will hit $100 billion by 2015.

From January to September, China's ODI rose by 10.4 percent to $36.27 billion, mainly targeting the mining, commercial service, manufacturing and retail sectors. Just more than 30 percent was achieved through mergers and acquisitions.

China's investment into the US registered staggering growth during the past nine months, yet some domestic companies felt obstacles had been placed in their way.

According to the Ministry of Commerce, China's US-bound investment for the first nine months of the year rocketed up by 530 percent from a year earlier, which contrasted with growth of 10.4 percent during the same period for the nation's total ODI.

"China's investment in the US has been much smaller compared with those in other regions, as small companies are usually incapable of investing there and big firms and State-owned enterprises find it difficult to make inroads due to invisible barriers," said Huo Jianguo, director of the Chinese Academy of International Trade and Economic Cooperation with the ministry.

The situation will not change soon, Huo said, and he is not "hopeful" about prospects for the near future.

"Restrictions will always exist, so it is hard for Chinese companies to invest alone in the US. But we can either seek out the possibility of cooperating with American counterparts for win-win solutions or expand sales and marketing there," he said.

The majority of China's investment in the US was conducted during the past two years. From January to September, Chinese companies invested funds worth $828 million, but this accounted for just 2.3 percent of the total. China's investment mainly goes to Asia and Latin America.

Despite growing enthusiasm, Chinese companies have encountered bottlenecks when investing in the US. The US Commerce Department recently announced it will investigate exports of China's clean energy sector for alleged subsidies provided by the Chinese government.

Yao Wenping, vice-president of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, said the probe will not only lead to shrinking Chinese exports, but also dampen confidence.

In July, some US congressmen urged the Obama administration to turn down a proposal by Anshan Iron and Steel Group to establish a joint venture with an American steel mill, but the deal was finally signed in September, the first case of a Chinese company investing in a US steel mill.

"We cannot find any real or obvious rules or regulations by the US government and governments from the European Union on restricting Chinese investment, but we sometimes experience unfair treatment, or say, investment protectionism," Chen said at the conference.

On China's rare earth exports, Chen said there would be no significant quota cuts.

"I don't think there will be a big cut in export quotas," Chen said, when asked whether China would slash exports next year.

"China has a management system, but China has no embargoes," he said. "But that does not mean you can buy freely, there will be a quota system - the quota system is a way of management."

Reuters contributed to this story.