Data

Property prominent for nation's policies

By Hu Yuanyuan (China Daily)

Updated: 2010-03-01 09:25

|

Large Medium Small |

In its latest annual Asian banking outlook, Fitch Ratings said a "bubble risk" was the greatest challenge for Chinese banks, given their 32 percent loan growth in 2009 and probable further growth of 20 percent in 2010. Nevertheless, it notes that the limited transparency of Chinese banks and their tendency to reschedule loans means that any resulting bad debt problems will be slow to surface, and that the Chinese authorities should have the time and resources to deal with any banking sector problems that may emerge.

The solution to this dilemma, according to the central government, is to develop more pillar industries to decentralize the power of the real estate sector.

Premier Wen Jiabao said on Feb 4 that plans should be made to develop a number of emerging strategic industries as the mainstay of China's economy as soon as possible, and traditional industries should be upgraded with the latest technology to enhance their efficiency and competitiveness. Wen added the development of science, education and culture was key to the transformation of China's economic growth model and its sustainable development.

However, in the short term, a challenge will be how to ensure a soft landing in the property sector.

"The property bubble is building up, but an urgent concern is to curb a further growth of the bubble while avoiding a hard landing that will seriously hurt the economy," said Tang Min, deputy general secretary of the China Development Research Foundation.

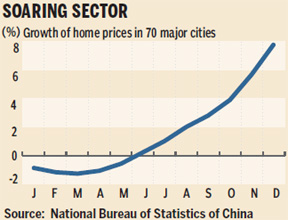

Statistics from Centaline China show that home sales in major cities declined in January from a month earlier as buyers continued to show reluctance to enter the market because of uncertain policy risks.

Yuwa Hedrick-Wong, Asia-Pacific economic advisor for MasterCard Worldwide, said unlike the property crash in the US, China's high real estate prices are shored up by residents' high saving rates.