Outbound investment still in beginning stage

Despite unprecedented opportunities abroad, China's outbound direct investment is still in a fledgling state, according to a poll undertaken by China's trade promotion agency.

A majority of the companies that responded to the survey, entitled Chinese Companies' Outbound Investment and Operation, said they were dissatisfied with the way business is conducted overseas, where economic, cultural and political difficulties abound.

Responding to opportunities abroad, Chinese companies have been extending their reach to more countries in Africa, Europe, North America and Latin America, as well as in Asia. More than half of the respondents to the survey, though, said they were not satisfied with the profits their overseas branches and operations make or the market shares that they hold.

A majority also said their businesses were doing better in Africa than in the United States and the European Union. They attributed their good African fortunes to the improved infrastructure and tamer competition on that continent, the survey said.

The China Council for the Promotion of International Trade published the results of the poll, which drew on interviews held with more than 1,000 outward-oriented Chinese companies hailing from 16 cities across the country.

"China's outbound direct investment is still at an early stage, and Chinese companies aspiring to invest abroad will have to face and deal with all sorts of difficulties," said Dong Jiayang, director-general of the economic information department of the council.

Of the companies surveyed, most said the overseas investments were made during the past five years. Only 3 percent said their overseas operations were established 10 years ago, the survey said.

Among the overseas projects undertaken by the companies surveyed, 70 percent were new, and 20 percent were done through joint ventures. The remaining 10 percent were made through mergers and acquisitions, it said.

"Chinese companies and their foreign counterparts should improve their understanding before undertaking acquisitions," said Robin Bew, chief economist at the research organization The Economist Intelligence Unit.

"One fruitful approach is to first form joint ventures or partnerships as a way of showing good intention."

Also in the survey, 56 percent of the respondents said they know a lot about the foreign markets where they do business.

"China is still a latecomer in outbound direct investment, and domestic companies aren't strong enough competitors," said Kong Linglong, director of the department of foreign capital and overseas investment of the National Development and Reform Commission.

China's outbound direct investment increased annually by double-digit percentages from 2006 to 2010 and is expected to continue surging as the Chinese government encourages businesses of all types to invest abroad.

By the end of 2011, China's cumulative investment in the United Kingdom reached $2.3 billion. Half of that was made in 2011 alone, said Wu Kegang, director of the UK China Business Chamber Ltd.

Some Westerners look askance at China's outbound investment, saying the country is merely going after resources abroad. The survey offered evidence to the contrary, showing that 66 percent of the interviewees were mainly involved in production and sales abroad; 58 percent in providing maintenance and after-sales services; and 54 percent in branding.

"China aims to tap the overseas market rather than grabbing natural or mining resources," Dong said.

In 2011, China made the fifth-largest amount of investment in the world, surpassing Japan and the United Kingdom. By the end of 2011, China's cumulative amount of outbound investment was more than $380 billion.

Window opens

The global financial crisis "creates strategically important investment opportunities for Chinese companies", said Long Guoqiang, director of the research department of foreign economic relations at the Development Research Center of the State Council.

"But the window of opportunity may not always be open, and Chinese companies should grasp opportunities," he said.

Kong agreed.

"Chinese investors' business opportunities are better than ever because of China's economic fundamentals, strengthened capabilities and the globalization of Chinese companies," he said.

Of the companies that responded to the survey, 73 percent said their moves overseas had benefited from government support.

In the first quarter of 2012, China's outbound investment into non-financial sectors increased by 94.5 percent from a year earlier, rising to $16.55 billion.

Shen Danyang, spokesman for the Ministry of Commerce, said such investment may continue to increase rapidly this year but probably not by as much as 100 percent in the first quarter.

Besides the government's policy, "countries throughout the world welcome Chinese companies" and "the nation's outbound direct investment will continue to increase quickly", said Wang Shengwen, deputy director-general of the ministry's department of outward investment and economic cooperation.

In developed nations, "we could look at high-tech industries, including those having to do with low-carbon and new energy technologies", Wang said.

In developing nations, he said, opportunities are likely to lie in "infrastructure and manufacturing".

Also of the surveyed companies, 50 percent said they had invested in manufacturing.

As Europe's debt woes spread, the region has taken pains to welcome Chinese investment.

"Chinese investment is really valuable for us (in Germany)," said Uwe Kerkmann, general director of the Office of Economic Development of City of Dusseldorf.

Not only do the Chinese sell products, "but they are also a strategic partner for Germany, transferring technology and know-how to us", he said.

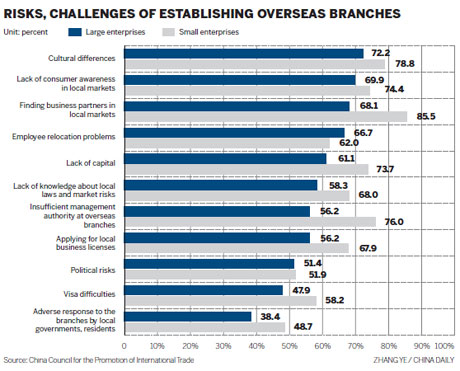

The survey found that more than 70 percent of the interviewees believe the biggest difficulties that arise in conducting business overseas stem from "the search for the right business partner, a lack of brand awareness in foreign markets and cultural differences".

"Chinese companies take on much bigger risks when they operate in Africa rather than in the US and EU," it said.

Then there are political risks and restrictions.

Last year, Chinese business tycoon Huang Nubo offered the equivalent of $8 million in the hope of acquiring a piece of land in Iceland. His plan was to turn the area, which occupies about 0.3 percent of the country's total landmass, into a resort and golf course. The proposal was rejected, though, by the Icelandic Interior Ministry, which said it did not comply with rules governing land ownership.

Huang said "political concerns" are the main obstacles that lie before Chinese companies that try to make acquisitions overseas.

Wang said the greatest difficulties Chinese investors are likely to face will stem from the weak world economy, protectionism, cultural conflicts and political turmoil.

"We will try to improve the rules and regulations, making things more convenient and offering financial support, amending the guidelines in a timely way and promoting investment agreements between China and the rest of the world," Kong said.

Ge Junjie, vice-president of the Shanghai-based food company Bright Food Group Co, said "it's a long-term trend for the Chinese food companies to make forays overseas".

Bright Food has completed two overseas acquisitions so far, buying a controlling stake in the New Zealand-based Synlait Milk Ltd for $58 million in 2010, and agreeing last year to spend $382 million for a 75-percent stake in Manassen Foods Australia Pty Ltd.

Contact the writers at dingqingfen@chinadaily.com.cn and hewei@chinadaily.com.cn

(China Daily 04/19/2012 page13)