Sands Macau gets nod for $2b IPO in face of glut

Updated: 2009-10-31 07:08

By George Ng(HK Edition)

|

|||||||

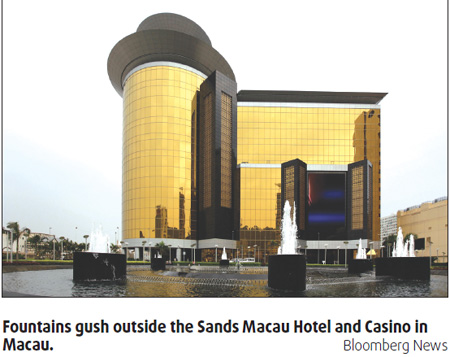

HONG KONG: Sands Macau, the Macao unit of casino operator Las Vegas Sands Corp, has won approval from the local stock exchange for its plan to raise $2 billion to $3 billion in an initial public offering, market sources said.

The company, which operates three casinos in Macao, will start pre-marketing activities next week and stage a roadshow the following week, with the trading debut tentatively scheduled for the end of November, sources said.

Citigroup, Goldman Sachs and UBS AG are the joint global coordinators for the IPO. They are also book-runners for the deal, along with BNP Paribas and Barclays, sources said.

Details of the planned fundraising exercise are not yet available.

The fundraising - if executed - will prove to be a great help to debt-burdened Las Vegas Sand, which is in need of cash to fund its suspended resort project on Macao's Cotai Strip.

However, how successful the Sands Macau IPO will remain anybody's guess, as some market watchers are cautious about the market response to the offering and its debut performance amid uncertainties faced by the industry.

"With an aggregate of over 4,000 gaming tables, Macao's casino industry is facing a facility glut," said Francis Lun, general manager at Fulbright Securities Ltd.

Competition will intensify, which will weaken the profitability of all players, unless patrons increase significantly, he said.

Prospects for the industry will depend largely on the mainland's travel policy, he added, noting that recent reports indicated that Guangdong province has curbed the frequency of visits by its residents to the gaming enclave.

Visitors from the mainland accounted for over 50 percent of Macao's total visitor arrivals in recent years, according to data from the Statistics and Census Service Bureau of Macau.

Against this backdrop, market response to the Sands Macau IPO is unlikely to be strong unless the company prices its shares conservatively, analysts said.

"The shares may slip under water if the company prices its IPO aggressively, as Wynn Macau did earlier," Fulbright Securities' Lun predicted.

Shares of rival casino operator Wynn Macau have fallen below their IPO price of HK$10.08, having closed at HK$ 9.970 Friday. The IPO price values Wynn Macau at 30 times its expected earnings per share (EPS) in 2009.

Thomas Ng, investment strategist at Quam Securities Co Ltd, agreed with Lun, noting that gaming stocks aren't the darlings of the market any more,

"It may be a good bet if the company prices its shares at a price/earnings (P/E) multiple below 20," he said, adding that he won't recommend the stock to investors at a P/E multiple that is over 20.

(HK Edition 10/31/2009 page5)