HK needs time to develop as offshore finance center: Analyst

Updated: 2010-06-30 07:24

By Emma An(HK Edition)

|

|||||||

|

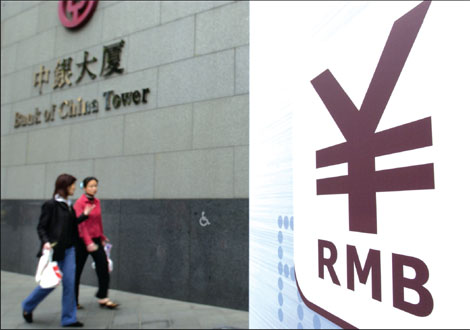

An advertisement for renminbi services beckons passers-by at the Bank of China headquarters in Hong Kong. Market analysts believe the city has a long way to go before it reaches the goal of becoming an offshore renminbi financial center. Dennis Owen / Bloomberg News |

Local banks hailed Hopewell Highway Infrastructure's plan to issue offshore renminbi (RMB) bond as a milestone of RMB business development in the city, but admitted that it will probably take 10 years before Hong Kong is fully established as an offshore RMB market.

"It is likely to take 10 years to attain that goal, given that the RMB business currently conducted in Hong Kong, such as the Renminbi-denominated bond issuance and cross-border trade settlement, has been quite limited up until now, which has to be attributed to the fact that the Chinese currency is not fully convertible," commented Liao Qun, chief economist and strategist of Citic Bank's China Operations at a press conference on Tuesday.

Just days ago, Hopewell Highway Infrastructure announced its plans to issue two-year RMB corporate bonds to institutional investors, being the first non-financial institution in Hong Kong to issue RMB-denominated bonds. Media reports said that approximately 1 billion yuan will be raised from this round of bond issuance.

In addition to the RMB bond issuance, the scope of RMB business in Hong Kong broadened when the People's Bank of China (PBoC) announced in June expansion of the pilot scheme for RMB settlement in cross-border trade, a significant move toward RMB internationalization.

Despite the recent breakthroughs, Liao predicted that to develop Hong Kong as a full-fledged RMB offshore financial center, the city will have a long way to go.

"The establishment of the offshore RMB market in Hong Kong can be realized only when the amount of deposits and loans denominated in RMB has surpassed those denominated in US dollars, with RMB accounting for more than 50 percent of the currencies in circulation, excluding the Hong Kong dollar. It would be difficult for the local banking system to achieve this target within one to two years," Liao suggested.

Liao was optimistic that the city can enjoy a first-mover advantage in RMB business, given that the mainland is gradually liberalizing its RMB capital account before the full convertibility of the RMB.

Liao suggested that mainland corporations and local Hong Kong residents should be allowed to invest in RMB-denominated financial products in the city. As a result, the local financial players will be encouraged to develop more RMB capital and asset management services for these clients to enhance the city's status as an offshore RMB financial center.

The yuan is expected to undergo gradual appreciation, with a 3 to 5 percent gain each year in the next couple of years. As the PBoC has just re-engineered the currency exchange rate flexibility, Liao predicted that the RMB can appreciate less than 3 percent in 2010.

China Daily

(HK Edition 06/30/2010 page3)