Plans aired for overseas real estate investment funds

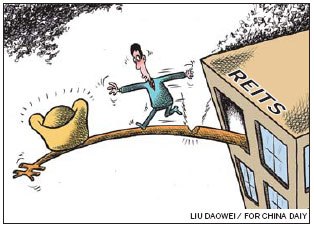

SHANGHAI - Catering to a craving for overseas property assets by mainland investors, at least two companies have applied to the Chinese authorities to sell real estate investment trusts (REITs) under the qualified domestic institutional investors (QDII) scheme.

The ban on domestic REITs is unlikely to be lifted anytime soon after the outbreak of the sub-prime mortgage crisis in the United States in 2008, which resulted in a global credit squeeze, analysts said. But the resulting economic downturn that has continued to trouble many developed economies seems not to have dampened Chinese investors' interest in snapping up prime properties in Hong Kong, London or New York.

Pending approval from the China Securities Regulatory Commission are the Lion Fund, managed by Shenzhen-based Lion Fund Management Ltd, and the Penghua Fund, run by Penghua Fund Management Ltd, also based in Shenzhen, according to a report in Caijing magazine. Both funds were established with the explicit purpose of investing in overseas properties.

Fund management experts said they expect it will take at least six months before the authorities will make a ruling on their applications.

Managers of both funds have said their funds would invest mainly in income-generating commercial properties, such as shopping malls, warehouses and office premises.

While Penghua has said it would focus on such properties in the United States and Canada, Lion has indicated that its interest would extend to Australia and Europe, with additional attention on hospitals and other healthcare facilities.

But the less-than-impressive investment record of China's QDII products has called into question the future of the two REIT funds, investment analysts said.

Although Lion Fund, established in January, has outperformed other QDII funds, it has failed to shine. QDII funds showed a combined loss of 180 million yuan ($27.8 million) in the first five months of 2011.

Moreover, the downward spiral in housing prices in the United States, which has yet to recover from the sub-prime crisis, has remained the root of concerns for many potential investors, despite the assertion by Lion Fund that it makes sense to begin buying while prices are low.

Liu Hongzhong, professor of finance at Fudan University, said: "I don't think it is advisable to enter the overseas housing market, especially that of the United States, now."

The Case Shiller Home Price Index in the United States is still in a downward trend and no one knows exactly how long it will take the market to recover, Liu said.

Analysts believe there is limited short-term room for growth in the overseas housing market and that REITs are more suitable for investors who want to diversify their investment portfolios and look for long-term rewards.

Yet access to the overseas property market does not solve the problem of limited investment opportunities in domestic channels.

Yin Kunhua, dean of the Shanghai Weston Real Estate Management Institute, said: "I think it more advisable to allow the launch of REITs domestically. It would help diversify investors' options and solve financing quandries for housing developers' financing predicaments, which face difficulties financing through bank loans."

China Daily

(China Daily 07/11/2011 page15)