Economic rebalancing needed to fix global economy

The meeting of G20 finance ministers and central bankers held in Moscow issued a statement against competitive currency devaluations. However, a supervisory mechanism is essential to reduce the negative spillover effect of various countries monetary policies, says an article in People's Daily. Excerpts:

Against the background of the faltering global economic recovery, the United States, Japan and the European Union are pursuing a policy of monetary easing to stimulate domestic economic growth and provide liquidity to financial markets.

Quantitative easing is essentially a short-term means to stimulate economic recovery, rather than a goal. The deep-seated causes of the global economic downturn lie in global imbalance and a financial bubble.

The recovery of the world economy requires governments to make medium- and long-term financial plans and economic restructuring. In this regard, the efforts made by the Chinese government are obvious to all. China has been committed to promoting economic restructuring and expanding domestic demand, making an important contribution to global rebalancing. While due to domestic political reasons, developed countries' macroeconomic policies show great uncertainty. The key to future global demand rebalancing is that developed countries should speed up structural reforms to improve competitiveness through labor market reforms and put forth medium- and long-term fiscal adjustment plans.

The defects of the dollar dominated international monetary system contributed to the formation of the US' indebted consumption pattern and Europe's debt crisis, and directly let to the outbreak of the international financial crisis. The US dollar is the main international reserve currency, which makes the Fed's monetary policy have a strong spillover effect.

The Fed's several rounds of quantitative easing heavily increased the global liquidity of the US dollar and brought dramatic fluctuations in the foreign exchange market, forcing other countries either to follow suit or to conduct the foreign exchange market intervention in order to stabilize the exchange rate. The European Central Bank and the Bank of England have followed suit to take the low interest rate and quantitative easing policy. Besides pursuing a policy of monetary easing, Bank of Japan also conducted frequent intervention in the foreign exchange market in order to avoid excessive appreciation of the yen.

These unilateral policies released liquidity and increased the variability of international capital flows, imposing macroeconomic and financial risks to emerging economies and planting hidden dangers for commodity and asset price inflation. Meanwhile, the practice of stimulating growth through currency devaluation can easily trigger retaliatory measures from trading partners. History shows that competitive currency devaluations usually lead to a lose-lose situation and cannot contribute to the global economic recovery.

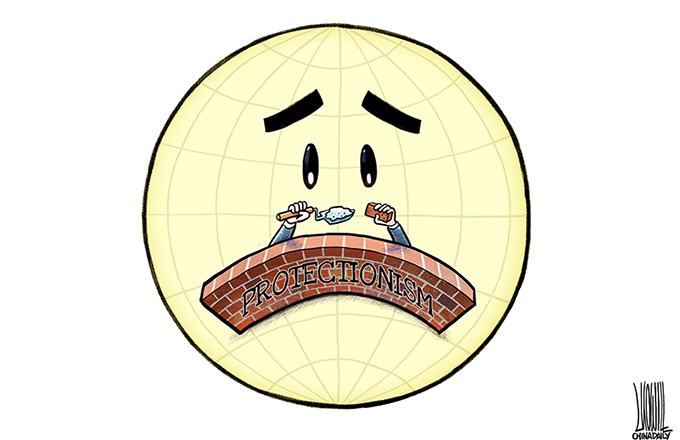

To stimulate demand and improve competitiveness through national currency devaluation may produce short-term effects, but it is not sustainable, and at the same time would have a negative impact on the world economy. As the main platform for global economic governance, the G20's declaration against currency wars is of great significance. However, to implement the consensus, a supervisory mechanism is essential.