Right to curb speculation in property

|

|

Models of residential buildings are seen at a property showroom in Binjiang district of Hangzhou, Zhejiang province, Sept 14, 2016. [Photo provided to chinadaily.com.cn] |

Shanghai and Tianjin have raised their down payment requirements for homebuyers in an attempt to cool their overheated property markets. First-time homebuyers in Shanghai now have to pay down payments of at least 35 percent, while the threshold for their Tianjin counterparts has reached 30 percent. Beijing News commented on Wednesday:

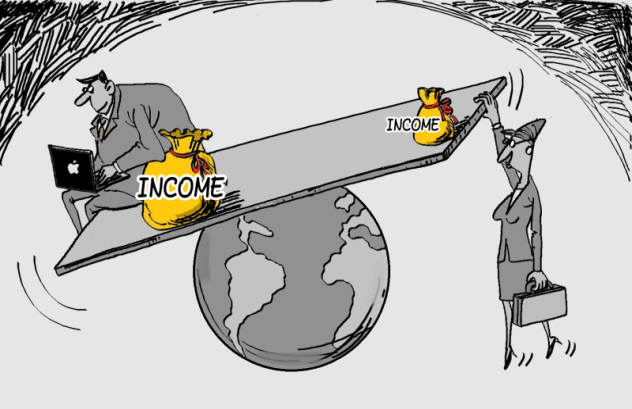

The property prices in major Chinese cities, especially in the mega cities, have risen far beyond market and policy expectations in recent years. The real estate prices in Beijing, Shanghai, and Shenzhen keep breaking records with no signs of slowing down, and they even make it to the top 10 most expensive cities for buying property worldwide.

But the irony is that the average income of residents in the three Chinese cities lags far behind the average income in other top 10 cities, not to mention the poorer air quality and urban environment. That explains why the "government is stepping up efforts to rein in prices".

Unlike in the past, the latest administrative efforts are expected to impose harsher restrictions on speculative homebuyers. Just two months ago, there were reports that a number of Shanghai couples faked their divorce in the hope of bypassing purchase limits to buy a second property.

As a result of the new measures, the prices of new residential property in major cities such as Beijing, Tianjin, and Shanghai began to decline in the second half of October, according to the National Bureau of Statistics. The downward trend is likely to continue, as the renminbi has continued to depreciate in value against the US dollar since it was included in the Special Drawing Rights basket of currencies on Oct 1 and the A-share market has little bubble left.

That could deal a blow to the overheated property market, because overseas investment will shrink accordingly especially when the country's growth reaches a new normal and begins to slow down. As such, the Chinese government has every reason to employ administrative measures to make sure the decline in property prices does not lead to a full economic crash.