Realty sector needs more balanced regulation

|

|

SHI YU/CHINA DAILY |

City governments across China have thrown everything but the kitchen sink at their real estate sector in an attempt to dampen demand and prevent a bubble from developing in the property market.

In the first two months of this year, China's real estate investment increased 8.9 percent year-on-year to more than 985 billion yuan ($143 billion), and sales jumped 26 percent to over 1 trillion yuan, according to the National Bureau of Statistics.

Despite the mild increase in home prices, as noted by the NBS, those who are selling or buying homes in big cities such as Beijing have actually found that prices have risen strongly in recent months. This fast rise, reported by the media, has further prompted potential buyers to swarm into the market, which in turn has further pushed up prices creating, in the process, a vicious circle.

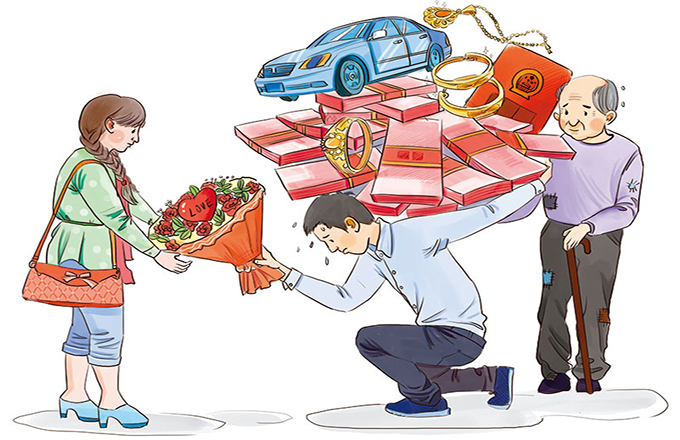

The city governments cannot sit idle as complaints from potential homebuyers, especially young people, continue to pile up. This month, Beijing and dozens of second-tier cities and cities neighboring Beijing and Shanghai imposed restrictions on housing purchases to cool their property markets, by either limiting the number of houses that can be owned by local residents or raising the percentage of down payment to make it financially more difficult to buy a second apartment.

The policies have to be tightened because in the recent increases in housing prices one can see the initial signs of a bubble. If the situation continues to worsen, it could jeopardize the country's financial security, because the bursting of any bubble will lead to a crisis, as the histories of other countries, such as Japan, show.

Some argue that the situation in Japan 20 years ago and that in China today are quite different and therefore cannot be compared. But even if we rule out the possibility of a bubble-burst, the soaring housing prices have put heavy pressure on young people, sharply raised the cost of manufacturing and other sectors, and risked guiding too much capital into the real estate sector instead of the real economy, as Vice-Premier Zhang Gaoli warned at the China Development Forum over the weekend.

While restricting property deals from the demand side is necessary, perhaps policymakers can more effectively tackle the problem from the supply side. In the past decade, several rounds of demand-side regulations were issued to impose restrictions on purchase. But instead of meeting the intended purpose of moderating housing prices, the restrictions, when eased, resulted in raising property prices.

China's real estate and related sectors account for a large proportion of fixed-asset investment, which is a major driving force for national economic growth. It will be difficult for the authorities to restrict property buying for long, because it will affect growth and employment, two factors high on the agenda of the central as well as local governments.

As we've seen in recent years, as economic growth slows down, policymakers will ease the restrictions on property buying, leading to an increase in realty prices.

Major cities like Beijing and Shanghai have been reducing the acreage of land for real estate development in recent years, thus restricting the supply of houses to change the demand-supply relationship. As a result, experts have attributed the current rise in prices to the reduced availability of land for construction, and called for more supply of land.

Obviously, if land supply continues to decrease, the surging demand may be repressed for some time, but once the restrictions are eased, there may be another round of demand-driven price rise, which could take the sector to a stage where the bubble could burst and neutralize the efforts of the policymakers.

It is time policymakers adjusted their regulation strategy and adopted a more balanced regulatory method to ensure housing prices ease gradually without causing any social or economic side effects.

The author is a senior writer with China Daily.

xinzhiming@chinadaily.com.cn

- Contract dispute between Chongqing-based Huacheng Xiwang Real Estate Development Co, Ltd, Hong Yulin, Huang Xinyun, Chongqing-based Laohu Assets Management Co, Ltd, Chen Yong and Gao Shanxue

- Real estate destocking still a priority for most Chinese cities

- Stock right transfer dispute between Shaanxi branch of China Cinda Asset Management Co, Ltd, Shaanxi-based Chongli Industrial Development Co, Ltd and Xi’an-based Jiajia Real Estate Comprehensive Development Co, Ltd

- Engineering construction contract dispute between Huating Zhongchi Real Estate Development Co, Ltd and Shaanxi-based Qin’an Construction Engineering Co, Ltd