Asian economy prepares for choppy seas

|

|

People walk outside the International Media Center (IMC) of the 2016 APEC Economic Leaders' Week in Lima, capital of Peru, on Nov 15, 2016. [Photo/Xinhua] |

The outlook for Asia and the Pacific is the strongest in the world, but it is shrouded by challenges at home and abroad, according to the latest International Monetary Fund report for the region. The April 2017 report, Regional Economic Outlook for Asia and Pacific: Preparing for Choppy Seas, says policy stimulus continues to support strong domestic demand in China and Japan in the near term, which is good for other economies in Asia as well. Broader global conditions are also favorable. Growth is accelerating in many major advanced and emerging market economies, notably the United States, and commodity exporters, and financial markets are still resilient for the most part. Nonetheless, there are challenges ahead. Particularly, over the medium term, there are fundamental headwinds to sustained strong growth, including aging populations in some countries and a slower catch-up in productivity.

After a slowdown last year, regional growth is forecast to speed up this year. Growth in the region dropped from 5.6 percent in 2015 to 5.3 percent last year despite broad improvement in economic activity in the second half of 2016. Net exports continued to pull down growth, but domestic demand remained strong, supported by robust private consumption. GDP growth is forecast to reach 5.5 percent in 2017, revised up by 0.1 percentage points compared to the estimate in the IMF's October 2016 World Economic Outlook, and 5.4 percent in 2018. Accommodative policies will underpin domestic demand, offsetting tighter global financial conditions.

The aggregate outlook for the region, however, masks differences across economies. Among the larger economies, projected growth in China and Japan for 2017 was revised up because of continued policy support and improved growth momentum toward the end of 2016.

China's GDP growth is expected to stay strong, although it could slow to 6.2 percent in 2018. Japan's growth is projected at 1.2 percent, which could weaken along with fiscal policy consolidation and the planned consumption tax increase. Some of the upward revision in Japan reflects the comprehensive revision of the national accounts this year. In India, growth is projected to rebound to 7.2 percent in the fiscal year 2017-18 and to 7.7 percent in 2018-19. In the Republic of Korea, growth is expected to remain subdued at 2.7 percent this year, owing to geopolitical uncertainty, and increase to 2.8 percent in 2018. Projected growth for Asia, excluding India and the ROK, was revised up in 2017 by 0.3 percentage points compared to the estimate in October.

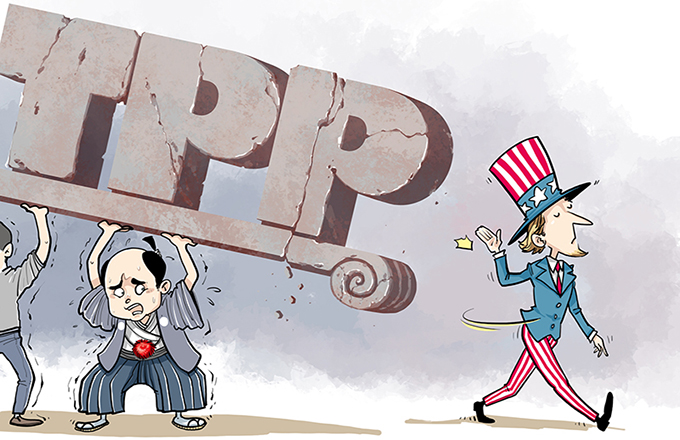

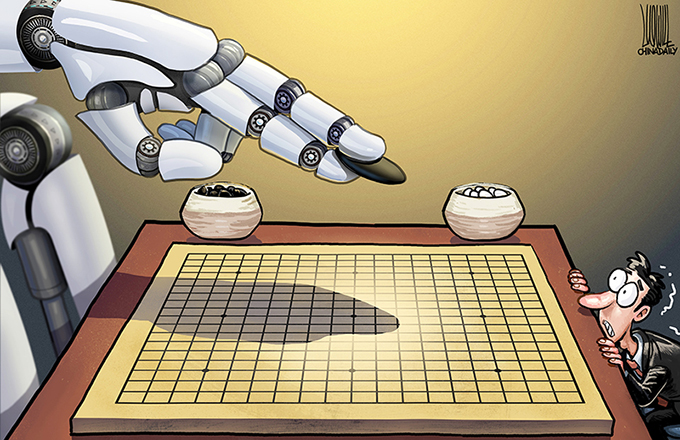

Although global growth could get a boost from economic stimulus in some large economies, particularly the United States, continued tightening in global financial conditions could trigger further volatility in capital flow. Private debt has risen in many economies in the region over the past decade, and higher borrowing costs could tip some companies and households over the edge and constrain growth. More inward-looking policies in major global economies would have a significant impact on Asia given that the region has benefited substantially from cross-border economic integration. A bumpier-than-expected transition in China would also have serious repercussions.

China can sustain its strong growth, but needs to more urgently implement reform to do so. First, the practice of setting high and hard growth targets should be de-emphasized, and the engine used to drive growth should switch faster from investment and industry to consumption and services.

Second, a key part of this switch should be to reduce public investment while increasing social spending on education, healthcare and social security.

Third, excessive growth of credit, more generally the financial system, should be slowed by tightening financial regulation and supervision (as is happening currently).

Fourth, State-owned enterprises should face hard budget constraints so they become more productive and release resources, such as credit, to be used more efficiently by the private sector.

Fifth, transparency needs to be increased, especially in how policies are communicated and in the quality of data provided to assess them.

And finally, modernizing the policy framework-investing in soft infrastructure-is needed to better manage the economy during the transition.

W. Raphael Lam is IMF deputy resident representative for China, and Alfred Schipke is senior resident representative for China.