Dan Steinbock

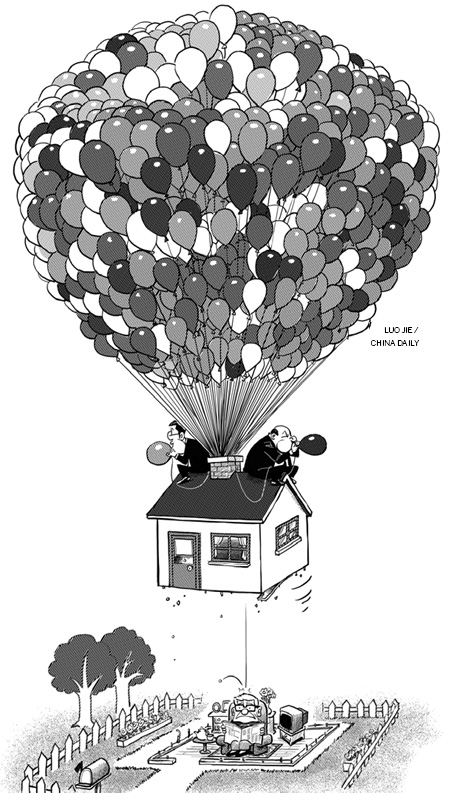

Balancing growth and realty prices

By Dan Steinbock (China Daily)

Updated: 2010-05-26 07:54

|

Large Medium Small |

And the successful lessons of government provision of public housing in Singapore and Hong Kong could be emulated.

But public sector measures will not suffice unless the incentives are right in the private sector. The mass-market housing reportedly accounts for only 10 percent of total residential sales. In the current business model, high margins derive from a very narrow high-end segment of the market. This made sense in the early days of Chinese real estate boom when only a few wealthy people could afford a home.

Today, far more Chinese are willing to and can buy a house. The changed situation demands a new business model, which can be based on the broad middle-class segment of the market. Margins will be lower, but the unit volume can be a lot higher.

The challenge is to introduce market-driven incentives for local governments and real estate developers to promote affordable mass-market housing. Aside from residential units China's property market comprises commercial, office, industrial and retail segments. And each has felt the impact of the global economic crisis, though differently.

The commercial property market is closely associated with foreign investment and international trade. In China, multinationals account for 30-70 percent of tenant demand in office properties. As a result, this segment was hit hardest by the collapse of exports. With recovery, the office market will thrive again, but that is more likely to happen in second-tier cities.

In contrast, the retail segment has been relatively steady because, in the absence of high unemployment, people continue to shop. Still, foreign retailers in China have opted for more cautious approaches to expand, because of global stagnation.

Industrial properties, particularly logistics facilities, have been driven by dual forces. In the port cities, logistics demand contracted with the collapse of exports, but the surge of internal demand has led retailers to lease warehouses, especially in mid-western China.

If services are taking off in the first-tier cities, industries are surging in second- and third-tier cities. The evolution of the property market reflects these shifts in China's economic development.

Today, China has some 360 million urban residents. In the next three decades, the figure will grow to 970 million. What the central government is trying to achieve is unique - to create urban space for more than 610 million people, within a single generation. In such an environment, periods of overheating will occasionally be accompanied by dramatic price rises.

Despite its rapid pace of expansion, China's real estate is still at a very preliminary stage. The marketplace is so colossal that there are no precedents, no simple models to describe it. In the pre-global economic crisis era, Beijing was often urged to liberalize, privatize and deregulate faster. If the Chinese financial sector had actually listened to the advice, China would have followed the G7 nations to the brink of financial meltdown.

It was caution and flexibility, gradualism and pragmatic thinking that spared China then - and that can deliver the promise of China's massive urbanization tomorrow.

The author is research director of International Business at the India, China and America Institute.

(China Daily 05/26/2010 page9)