German car manufacturers under pressure

There is still time for the EU and China to avoid new tariffs and agree on local content requirements that serve all

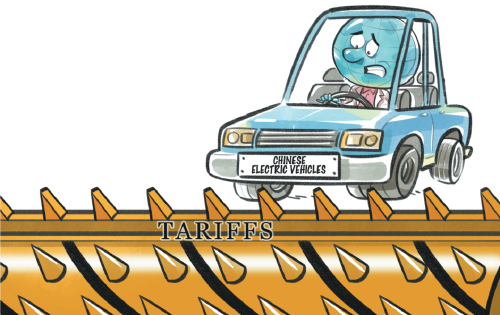

In mid-June, after months of investigation, the European Commission announced potential import tariffs on battery electric vehicles from China in the range of 17 to 38 percent, differentiated by manufacturer. This would be on top of the current standard tariff of 10 percent.

The decision is preliminary and needs to be confirmed by the commission by July 4. The new tariffs are the subject of much debate among EU policymakers. In particular, the German government, and automakers headquartered in Germany, are positioned against higher import tariffs.

After growth in recent years, China-headquartered manufacturers today account for about 3 percent of all new passenger car registrations in Germany. Brands of Japan and the Republic of Korea make up 8 percent and 6 percent of the market respectively, and manufacturers of the United States are another 7 percent. The remaining three-fourths of Germany's new car sales are provided by German brands (about 50 percent) and other Europe-headquartered manufacturers (about 25 percent).

However, when we look at battery electric vehicles only, Chinese brands already account for 8 percent of new car registrations in Germany. China-headquartered manufacturers recognized early how important it is to invest in battery technologies and vehicle electrification, and they are now benefiting from economies of scale and strong supplier networks. German manufacturers, meanwhile, have remained heavily reliant on combustion engine vehicle technology and are now perceived as late in offering attractive and affordable electric models.

The German government's purchase incentives for electric vehicles ended rather suddenly in late 2023, and the market share of battery electric vehicles has been stagnant at around 13 percent. But in 2025, the next level of car carbon dioxide standards that will come into effect in the European Union is expected to sharply increase electric vehicle market shares again. Some worry that a large fraction of this additional European demand will be met by vehicle imports from China.

European import tariffs may be perceived as a viable protection mechanism at first sight. But they present a dilemma for German automakers for two reasons.

First, it's not actually easy to put a stamp of origin on a manufacturer. A good example is the Smart brand. Originally fully part of Mercedes-Benz, it is now half owned by Geely and half by Mercedes-Benz. Not a single Smart model is produced in Europe — the vehicles all come from China. According to the EU Commission's plans, a duty of 21 percent would be levied on Smart vehicles. Other models from manufacturers that are at least in part German would be similarly affected. This shows how the tariffs under discussion could affect Europe's domestic industry, as well.

Second, if the Chinese government decided to respond with increased tariffs on vehicle imports from Europe, German automakers would be hit especially hard, as they have a long history of sales activity in China. Today, about 17 percent of all new car sales in China are by German brands.

Those impacted the most by increased tariffs might be consumers, though, in Europe and in China. Increased import tariffs would artificially increase vehicle prices, and consumers would have to pay in the end. At a time when we must urgently speed up the deployment of electric vehicles, this would be a step backward and risks losing precious time.

From what we know today, battery electric vehicles are the only technology that can deliver enough carbon dioxide savings for road transport to decarbonize within the time frame of the Paris Agreement. This is on top of other benefits such as drastically reduced air and noise pollution, and avoided oil imports.

Combustion engine vehicles have served German brands well in previous years, but ultimately this technology doesn't have a future. There is no question that German manufacturers are increasingly feeling the pressure to transition to cleaner technologies more rapidly. Premium brands such as BMW and Mercedes already got hit by surprise when Tesla sales skyrocketed some years ago. Now it is up to mass-market brands, such as Volkswagen, to better prepare to compete with affordable, right-sized battery electric vehicles manufactured by Chinese companies.

A fear regularly expressed is that the German car industry could find itself marginalized like the German solar panel industry was in the 2010s. Back then, German companies were leading in developing innovative solar panels but were then displaced by Chinese brands selling at very competitive prices. Today, about 90 percent of solar panels in Germany are imported from China. In Germany, this is a lesson remembered not only by policymakers and the industry, but also one that lives on in the public memory and influences public opinion.

Increased import tariffs on cars are not the only option. The EU and China could instead agree on local content requirements for electric vehicles. For many years, foreign vehicle manufacturers have had to produce locally in China, usually in collaboration with a Chinese manufacturer, to gain market access. A similar requirement in the EU could help ensure that Chinese manufacturers develop local production capacities that create jobs in Europe.

The clock is ticking, but there are still a few weeks before July 4. That means there is still time for a solution that serves all, including our climate and the environment, as well as consumers and industry in the EU and China.

The author is managing director of the European entity of the International Council on Clean Transportation. The author contributed this article to China Watch, a think tank powered by China Daily.

The views don't necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn.