Illegal fintech activities worth 30b yuan weeded out

China's public security authorities uncovered more than 1,500 cases involving illegal financial activities worth nearly 30 billion yuan ($4.27 billion) during a six-month special operation, according to data released by the Ministry of Public Security on Thursday.

The campaign, jointly launched by the ministry and the National Financial Regulatory Administration, was carried out in 17 key provinces and municipalities from June to November to address the root causes of financial disputes and risks. It involved nearly 60 coordinated raids, dismantled more than 200 professional criminal gangs and helped cleanse the financial market.

Hua Liebing, director of the ministry's economic crime investigation bureau, said rising consumer disputes in the financial sector in recent years have fueled the growth of illegal intermediaries. These actors spread rapidly online, forming a complete "black and gray" industrial chain that seriously infringes on consumers' rights and disrupts financial market order.

Hua said such crimes have developed into a full industrial chain that includes false advertising, so-called countermeasure tutorials, customized scripts, forged certificates and agency negotiations. Practitioners are highly professional, with some lawyers and debt collection agency employees joining "anti-debt collection" teams for profit by exploiting their knowledge of laws and credit compliance rules. This has given rise to professional complainants and agents. Criminals also increasingly use new technologies and artificial intelligence tools, making detection more difficult.

Many of these illegal activities rely on internet technologies, with products that are multilayered and nested, complicating identity verification. The trend toward internationalization of such crimes has also become more evident, Hua said. Complex legal relationships, coupled with criminals exploiting loopholes and disguising illegal purposes as legitimate activities, further hinder crime detection.

"With intensified regulation and crackdowns, such illegal activities will become more concealed and their methods more complex," he said.

In August, police in Qingdao, Shandong province, investigated a loan fraud case involving a suspect surnamed Wang and others.

Since 2020, the group, acting as first-tier loan intermediaries, has developed more than 10 second-tier intermediaries to recruit locals to carry debt.

They forged bank statements, property deeds and work certificates to qualify debt carriers for high-value mortgages, colluded with appraisal firms to inflate property values, and bribed bank staff to secure loan approvals, defrauding more than 120 million yuan in housing loans. Suspects including Wang and Cheng have been arrested, and the case remains under investigation.

Xing Guijun, director of the NFRA's investigation bureau, said the growth of financial "black and gray industries" has been a longstanding problem requiring sustained governance.

While recent efforts have curbed their spread, increasingly concealed and evolving criminal methods have made enforcement more difficult.

"These industries have evolved into high-tech, large-scale, intelligent and industrialized fraud, outpacing traditional risk control measures," Xing said.

Effective governance requires stronger law enforcement and judicial coordination, as well as financial institutions taking primary responsibility for comprehensive risk and compliance management to build solid defenses.

Xing said financial institutions should better regulate cooperative partners, strengthen third-party qualification checks and supervision, and improve complaint-handling and assessment mechanisms.

He also called for increased investment in technology, including the use of big data and artificial intelligence to enhance risk identification and build intelligent prevention systems.

In March, the NFRA and the Ministry of Public Security issued regulations on transferring suspected criminal cases, laying an institutional foundation for joint law enforcement. By the end of November, more than 4,500 leads involving 21 billion yuan had been transferred to public security authorities, while financial institutions, under official guidance, reported 1,700 cases involving 17 billion yuan.

In 2026, the NFRA will intensify crackdowns on key illegal financial activities, including illegal loan intermediaries and agency services, maintaining a high-pressure enforcement posture, Xing said.

Authorities will strengthen cross-departmental cooperation with market regulators and judicial bodies, develop standards for evidence transfers to improve administrative-criminal coordination, and conduct joint research to propose legislative recommendations on financial crime regulation.

- Stricter race rules planned for second robot half-marathon

- Illegal fintech activities worth 30b yuan weeded out

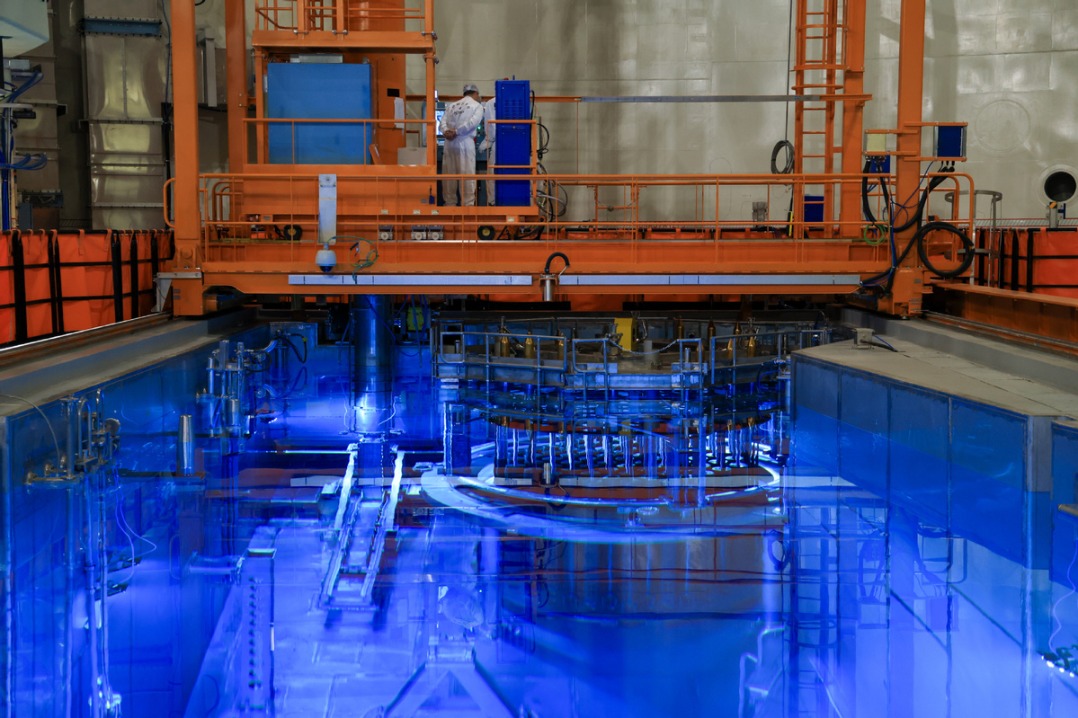

- Unit 1 of Taipingling nuclear power plant starts fuel loading in China's Guangdong

- New AI alliance to foster open-source tech network

- Kunming police dog is now a natl all-rounder

- 'China solution' targets high-risk breast cancer