|

|

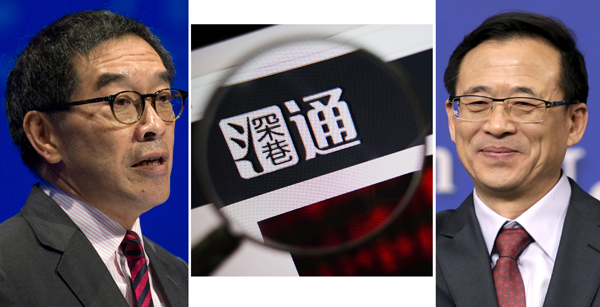

Hong Kong Securities and Futures Commission Chairman Carlson Tong (left) and Liu Shiyu, chairman of the China Securities Regulatory Commission (right). The State Council has given the green light to a long-awaited plan to connect the Shenzhen stock exchange with Hong Kong's, further opening up China's capital markets. BY REUTERS/XIAO MU/CHINA DAILY |

Cheaper stock valuations, the yuan factor, hedging possibilities hold key

The Shenzhen-Hong Kong Stock Connect may benefit the Hong Kong stock market more than Shenzhen's due to valuation concerns, the foreign exchange factor and value-hunting.

The State Council on Tuesday had okayed the second mainland stock exchange link with Hong Kong, saying the preparation work has been completed and approved.

Hong Kong Exchanges and Clearing Limited-HKEx-expects the new link will be implemented by the year-end.

There will be no aggregate trading quota when trading starts between the Shenzhen and Hong Kong exchanges. The total quota will be removed for the existing Shanghai-Hong Kong Stock Connect that became operational in 2014, the China Securities Regulatory Commission said.

The daily limit on the Shenzhen-Hong Kong link will be the same as that on the Shanghai-Hong Kong link: 13 billion yuan for orders going from Hong Kong to the mainland and 10.5 billion yuan for orders coming from Shenzhen to Hong Kong.

"We think that the Hong Kong market, on balance, stands to gain more from portfolio diversification of mainland investors. Mainland investors acquiring Hong Kong dollar-denominated stocks can hedge against the risk of renminbi depreciation. The cheap stock valuations of the Hong Kong market also offer good bargains for mainland investors," said Aidan Yao, senior emerging market Asia economist at AXA Investment Managers, the asset management arm of French insurer AXA.

"The Shenzhen-Hong Kong Stock Connect is complementary to the Shanghai-Hong Kong Stock Connect. The Shanghai market has more 'old economy' companies that come from traditional industries and more large-cap stocks, whereas Shenzhen has more 'new economy' companies offering access to small- and mid-cap growth stocks," said Sally Wong, CEO of the Hong Kong Investment Funds Association.

HSBC said in a market strategy report it expects the new link will likely boost Hong Kong small-caps' performance. But the link also provides industry-level exposure to overseas investors keen on Shenzhen's promising high-growth companies.

The link will also likely bolster cross-border yuan flows, strengthen the development of the mainland A-share market's hedging mechanism and boost A shares' prospects for inclusion in the MSCI Emerging Market Index, HSBC said.

"The Shenzhen-Hong Kong Stock Connect will stimulate overall demand for offshore yuan as overseas investors need the yuan to settle share transactions arising from the stock market link," said Su Jie, senior economist at Bank of China (Hong Kong).

BoCHK is also optimistic the new link will fortify the hedging mechanism of the A-share market.

"The Hong Kong equity market is dominated by overseas institutional investors that operate under a sophisticated regulatory framework. Hence, mainland investors can hedge investment risks on their mainland share portfolios by buying Hong Kong-listed stocks," Su said. "The link can help develop the hedging product mechanism of the A-share market in future."

The link will enable overseas investors to trade in 880 stocks listed on the Shenzhen Stock Exchange Component Index and the Shenzhen Stock Exchange Small/Mid Cap Innovation Index, whose collective market value is more than 6 billion yuan. They can also buy stocks listed in both Shenzhen and Hong Kong.

Buying shares traded on Shenzhen's ChiNext small-cap gauge will be limited to institutional investors at the initial stage of the link.

The link represents the second channel for foreign investors to buy mainland's stocks. It also lifts restrictions on asset flows, and could potentially pave the way for inclusion of the A shares in the MSCI indices in future.