Time to deleverage and slow overseas expansion

|

|

People walk past a money exchange decorated with different currencies in Hong Kong, June 27, 2016. [Photo/IC] |

The Chinese government reiterated on Monday the country will continue to support the healthy development of its outbound investment after reports suggested it is guarding against money outflows disguised as foreign investment.

Officials from the National Development and Reform Commission, the Ministry of Commerce, the People's Bank of China and the State Administration of Foreign Exchange said the government is sticking to its opening-up policy and "going out" strategies, and facilitating investment abroad while guarding against foreign exchange risks.

For the last couple of years, there has been a steady flow of capital from China to overseas in direct commitment and portfolio investment.

In the first nine months, China reported more than 50 percent annualized growth in its outbound non-financial investment, totaling $134 billion, more than the foreign direct investment it received during the same period.

Of that amount, mergers and acquisitions were worth $67.4 billion, and more than 20 percent was in the United States.

More recently, the transfer of capital has appeared more attractive as the US dollar's exchange rate has risen steadily against many other currencies, the Chinese renminbi included. The yuan has fallen more than 6 percent versus the dollar this year, although it has remained relatively stable against other currencies in its exchange basket.

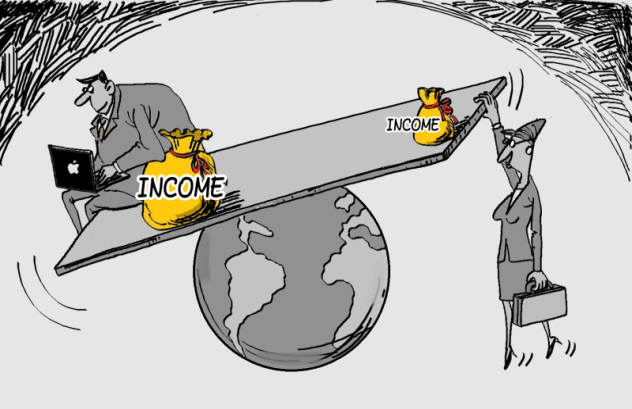

By and large, Chinese investors' hunt for higher earnings from overseas is a natural development stemming from the country's economic progress over the last few decades. However, too rapid expansion in overseas assets doesn't seem a rational thing to do, especially at a time of new uncertainties. Risky overseas investments could threaten financial stability.

Meanwhile, for mainland investors to build up their overseas portfolios, perhaps a more convenient, and less risky, way to do so is through Hong Kong, by adding the investment instruments to the stock trading connects newly built between the stock exchange in the special administrative region and the bourses in Shanghai and Shenzhen. And in this way, domestic investors will have no need to frequently convert their money to and from the US dollar.

For investors with a long-range view, the renminbi can also be a hedge, because in comparison with most other currencies in the world, it is still relatively attractive thanks to the country's economic growth and the government's continued reforms.