Ratings agencies 'underestimated' China's ability to deal with economy

The Finance Ministry expressed disapproval on Friday over major rating agencies' recent downgrade of China's credit outlook, saying the worries were "unnecessary".

"Rating agencies have overestimated the difficulties the economy faces and underestimated the ability of the Chinese government to press ahead with reforms and tackle risks," said Shi Yaobin, vice-minister of finance, in a formal statement.

"Their worries over the restructuring of the economy, the debt problem with the real economy, the reform of State-owned enterprises and financial risks is unnecessary," he said.

Shi's comments came one day after Standard & Poor's Ratings Services cut the outlook for Chinese government credit from "stable" to "negative", becoming the second major global rating agency to do so after Moody's Investors Service.

S&P attributed its dimmer outlook to its expectation that China will move slowly on economic rebalancing and reining-in runaway credit growth. It said government and corporate leverage ratios are likely to deteriorate, and that the investment rate could well be above sustainable levels of 30-35 percent of GDP and among the highest ratios of rated sovereigns.

That said, S&P maintained its "AA-" sovereign credit rating for China, acknowledging that there were some encouraging signs in the economy, including the anti-corruption campaign, reforms of budget frameworks and the financial sector, as well as the government's growing tolerance toward companies facing closure or default. But it cautioned that the pace and depth of SOE reform may be insufficient to ameliorate the risks of credit-fueled growth.

Shi said that as structural reform deepens, China will continue to grow at a medium to high pace, and that will provide a solid basis for a sustained stable credit rating.

This is not the first time that officials have criticized rating agencies. Responding to concerns over Moody's lowering of the outlook, Finance Minister Lou Jiwei said at the recent China Development Forum that he "doesn't care" about the rating because he didn't see negative fallout in any market, international or domestic, as a result.

Friday's statement was toned down from a previous statement on Wednesday in response to Moody's. An unattributed official from the ministry said then that the action was the result of "insufficient knowledge" about China's economy.

"When an economy is in an upward cycle, rating agencies tend to raise their ratings, failing to identify underlying risks in the economy. And when an economy is in a downward cycle, agencies cut the ratings and exacerbate the risks," the official said.

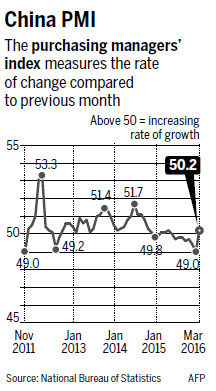

The March Purchasing Managers' Index for the manufacturing sector, released on Friday, was another rebuff to Moody's and the S&P's downbeat assessments.

The index exceeded forecasts and rose to 50.2, its highest since August and the first time in nine months it had entered expansionary territory.

Zhang Lianqi, a partner at Ruihua Certified Public Accountants, said rating agencies' assessments could be used by investors to short the economy and currencies and spread panic across financial markets.

Zhang suggested that China should warn the agencies that they will pay a price for irresponsible ratings.

zhengyangpeng@chinadaily.com.cn